Service hotline

+86 0755-83975897

Release date:2024-10-24Author source:KinghelmViews:1873

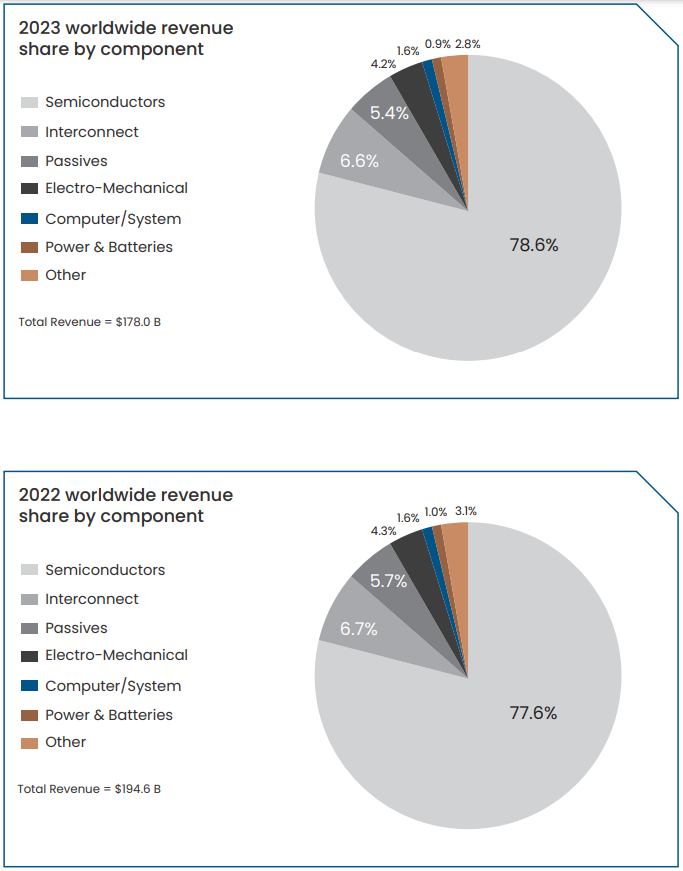

The 2024 Global Component Distributor Top 50 Report, authored by ECIA Chief Analyst Dale Ford, sheds light on the evolving landscape of component distribution across key markets. This analysis includes data from the United States, Taiwan, China, Japan, Europe, South Korea, and Singapore. With 2023 seeing a combined revenue of $178 billion from the top 50 distributors—down from $194.6 billion in 2022—this report highlights significant trends and key players in the industry.

Key Findings

1. Revenue Trends

U.S. Dominance: The United States boasts 12 companies on the list, generating $71.9 billion, accounting for 40.4% of total revenue. While this marks a slight decline from 40.6% in 2022, the U.S. remains a powerhouse in the component distribution market.

Taiwan's Stronghold: Taiwan contributes 7 companies with a total revenue of $54.1 billion, representing 30.4% of the market share. This is down from 29.7% in the previous year.

Emerging Markets: China, with 19 companies, reached $23.8 billion (13.4%), while Japan's 8 companies accounted for $21.7 billion (12.2%).

2. Regional Revenue Breakdown

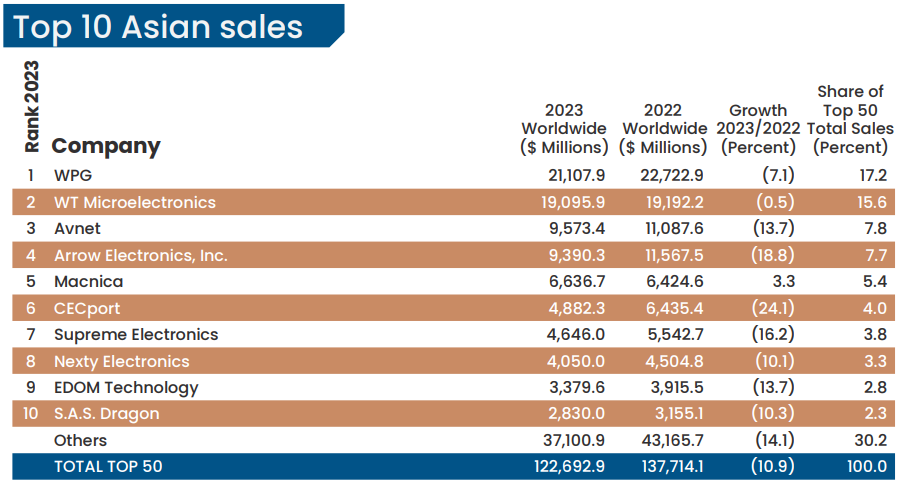

Asia-Pacific Region: The Asia-Pacific total reached $122.7 billion, a decline from $138.2 billion in 2022. Mainland China and Hong Kong comprised 60.3%, with Taiwan and Japan following at 12.2% and 11%, respectively.

Americas and EMEA: The Americas made up 16.3% of total revenue, while EMEA represented 14.8%, showcasing a balanced distribution of market power across regions.

Top 10 Distributors

Americas

Avnet: $8 billion

Arrow Electronics: $6.6 billion

Digi-Key: $2.4 billion

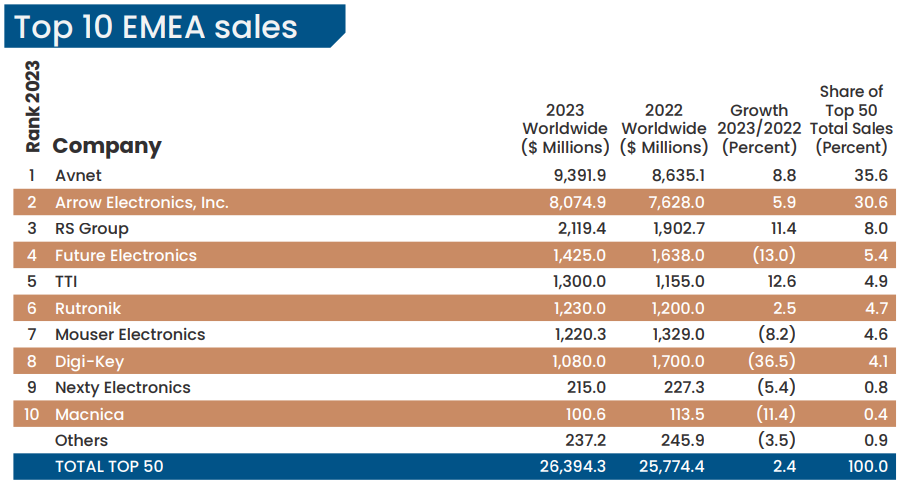

EMEA

Arrow Electronics: $9.4 billion

Avnet: $8.1 billion

Future Electronics: $2.1 billion

Asia-Pacific

WPG Holdings: $21.1 billion

Winway Technology: $19.1 billion

Arrow Electronics: $9.6 billion

Market Insights

Semiconductor Dominance

Semiconductors continue to lead the charge in component distribution, accounting for 78.6% of total revenue. This trend emphasizes the ongoing demand for advanced electronic components across various sectors, including automotive, telecommunications, and consumer electronics.

Future Outlook

With the semiconductor market thriving and growing innovation in technology, the outlook for component distributors remains optimistic. Companies must adapt to evolving consumer demands and invest in new technologies to maintain their competitive edge.

Conclusion

The 2024 Global Component Distributor Top 50 Report highlights critical trends and shifts within the component distribution landscape. As the industry adapts to market changes and technological advancements, key players will continue to navigate these challenges to ensure sustainable growth. For businesses and stakeholders, staying informed about these trends is essential for strategic planning and investment decisions.

Copyright © Shenzhen Kinghelm Electronics Co., Ltd. all rights reservedYue ICP Bei No. 17113853