Service hotline

+86 0755-83975897

Release date:2024-09-16Author source:KinghelmViews:1891

Summary

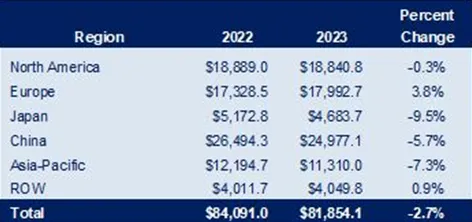

In the global connector industry, 2022 saw a growth of 7.8%, but this momentum faltered in 2023, with a 2.7% decline in sales, amounting to a $2.2 billion decrease. All regions except Europe and the Rest of the World (ROW) experienced sales drops, with Japan and the Asia-Pacific region facing the steepest declines. Despite this downturn, Europe recorded a 3.8% increase in sales, and ROW saw a modest 0.9% growth. Historical data shows only ten instances of sales decline over the past 44 years, with 2009 being the worst year. Although sales showed some improvement at the end of 2023 and into early 2024, the recovery was not as dramatic as the rebound in 2010. Looking ahead, the connector market is expected to grow by 4.2% in 2024. Key end-use sectors remain telecommunications/data communications and automotive, with commercial/office equipment showing minimal growth in 2023.

Image from Internet

After a 7.8% increase in 2022, the global connector industry experienced a slowdown in 2023. Sales dropped by 2.7% from 2022 to 2023, translating to a decrease of $2.2 billion in revenue. All regions except Europe and the Rest of the World (ROW) saw a decline in sales, with Japan experiencing the largest drop at -9.5%, followed by the Asia-Pacific region with a -7.3% decrease. Europe saw a growth of +3.8%, and ROW experienced a modest increase of 0.9%.

The chart below shows the percentage change in global connector sales annually since 1981. Over the past 44 years, there have been only ten years of declining sales. In 2009, the industry faced its worst year with a -21.8% decline. However, 2010 saw a remarkable recovery with a +28.2% growth, marking the largest year-on-year change in the industry’s history. While connector sales showed some improvement at the end of 2023 and the beginning of 2024, it did not reach the dramatic levels seen in 2010. Forecasts predict a 4.2% growth in connector sales for 2024.

World Connector Market by Region and Percentage Change (2022 - 2023)

Regional Summary

As shown in the table, the mixed results for 2023 based on global regions have impacted the 5-year, 10-year, and 20-year Compound Annual Growth Rates (CAGR) in various ways. Comparing 2023-2024 with 2022-2023, the global CAGR for each period has decreased. However, individual regions have seen differing changes based on their growth trends. For instance, Europe achieved growth in 2023, resulting in improved 5-year, 10-year, and 20-year CAGRs. In contrast, China saw a decline in sales in 2023, which led to a decrease in its CAGR for the same periods. In regions where growth or decline rates were below 1.0%, CAGR remained relatively stable or showed minimal fluctuation.

Regional Growth Rate (Forecast for 2023 - 2024)

Regional Growth Rate (2022 - 2023)

Telecommunications/data communications remain the largest end-use sector for electronic connector products, followed by the automotive sector. It is expected that by 2024, telecommunications/data communications will continue to be the largest end-use sector, with automotive remaining in second place. Commercial/office equipment experienced the smallest growth in 2023.

Disclaimer: The information above is sourced entirely from the internet and does not represent the views of this account. If there are any infringements or objections, please contact us for removal.

Copyright © Shenzhen Kinghelm Electronics Co., Ltd. all rights reservedYue ICP Bei No. 17113853