Service hotline

+86 0755-83975897

Release date:2021-12-28Author source:KinghelmViews:2096

1 In the 5G era, RF front-end ushered in deterministic growth opportunities

1.1 The RF front-end is an important part of the mobile phone wireless communication module

Radio frequency is an important component of analog ICs in semiconductor integrated circuits.Semiconductors are divided into discrete devices and integrated circuits. According to the characteristics of processing signals, integrated circuits are divided into analog ICs and digital ICs. Digital ICs are used to process digital signals (such as CPU, logic circuits), and analog ICs are used to collect real-world signals (including light, sound, temperature, humidity, etc.). , pressure, current, concentration, etc.), and processing including amplification, filtering, etc., can be further divided into power IC, signal chain, radio frequency, etc. according to the type of signal processed. The RF devices mainly include power amplifiers, RF switches, and low-noise amplifiers. In addition, the filters in the RF front-end are passive devices (passive components), and semiconductors are active devices.

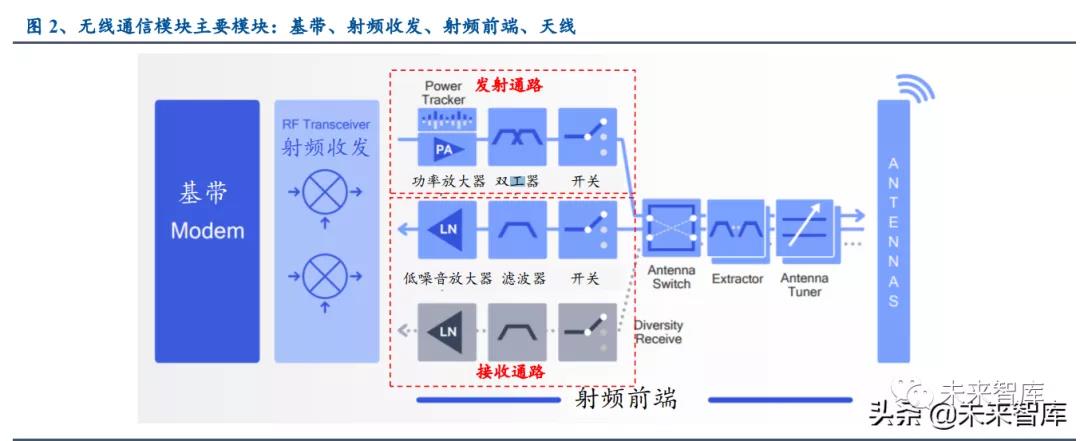

The RF front end is an important part of the wireless communication module of the mobile phone.The wireless communication module of the mobile phone consists of four parts, namely the antenna, the radio frequency front-end (RFFE, Radio Frequency Front-end), the radio frequency transceiver (RF Transceiver), and the base band (BB, Base Band), which together form the receiving path/downlink (ie Receive, Rx) and transmit path/uplink (ie Transmit, Tx). Simply put, the baseband signal refers to the required processing signal, such as the audio received by the microphone, but its frequency is low, which is not suitable for distance transmission (one is that the length of the antenna is proportional to the wavelength, and the other is that the low-frequency spectrum resources are limited), so It is necessary to load the low-frequency baseband signal onto the higher-frequency electromagnetic wave, that is, use the radio frequency current as the carrier. The above process is called baseband modulation (the reverse process is demodulation), while the RF front-end filters and amplifies the RF signal.

The RF front-end filters and amplifies the signal through PA and filter. The main components of the RF front-end include: Power Amplifier (PA, Power Amplifier), Filter (Filter), Switch (Switch), Low Noise Amplifier (LNA, Low Noise Amplifier), Tuner (Tuner), Dual/Multiplexer (Du /Multiplexer).

(1) PA: Generally located in the uplink, it is used to increase the signal power and is an active device. Due to the link attenuation in the wireless transmission process, the power of the signal at the transmitter must be large enough to ensure long-distance transmission, and the PA is to obtain energy from the power supply to amplify the output power of the signal. Its main process technologies include low-frequency Si-CMOS and high-frequency GaAs/GaN.

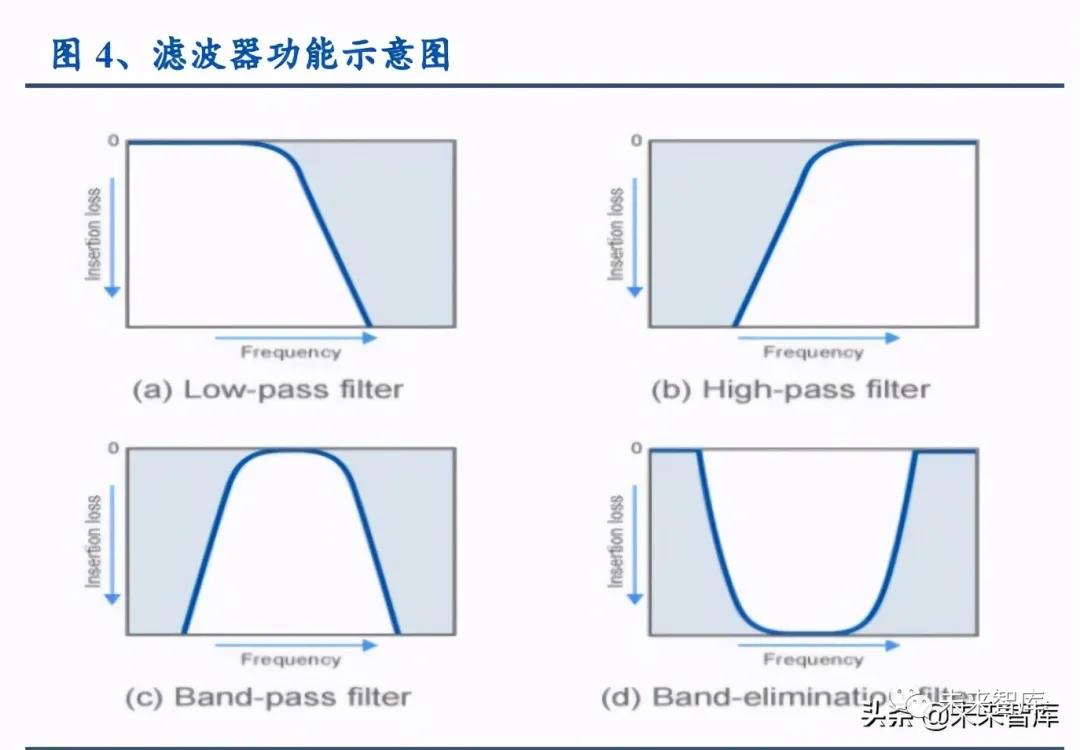

(2) Filter: Filter out frequencies other than a specific frequency, which is a passive device. A filter consists of a combination of resistors, inductors, and capacitors, where inductors block high-frequency signals and allow low-frequency signals to pass, while capacitors do the opposite. The filter has four modes, low-pass filter (to filter out high-frequency signals), high-pass filter (to filter out low-frequency signals), or a combination of the two to form a band-pass filter and a band-stop filter. Its main process technologies include SAW, TC-SAW, BAW-FBAR, BAW-SMR.

(3) Others: The switch is used to switch the RF transceiver channel; the LNA is located on the receiving channel, suppressing noise and amplifying the weak signal received by the antenna; the duplexer is composed of a receiving end filter and a transmitting end filter, which is used to realize Isolation of RF transceiver channels.

The value of PA and filter accounts for 34% and 54%. The main costs of mobile phones include displays (about 20%), cameras (about 10%), and motherboards, of which the motherboard mainly includes three major chips, namely the main chip (about 15%), the storage chip (about 10%), and the RF front-end (about 10%). 8%). In the RF front-end, PA and filter are the two devices with the highest value, accounting for 34% and 54% respectively.

1.2 The unlocking of new frequency bands brought about by the change of communication generations is the core driving force for the growth of RF front-end

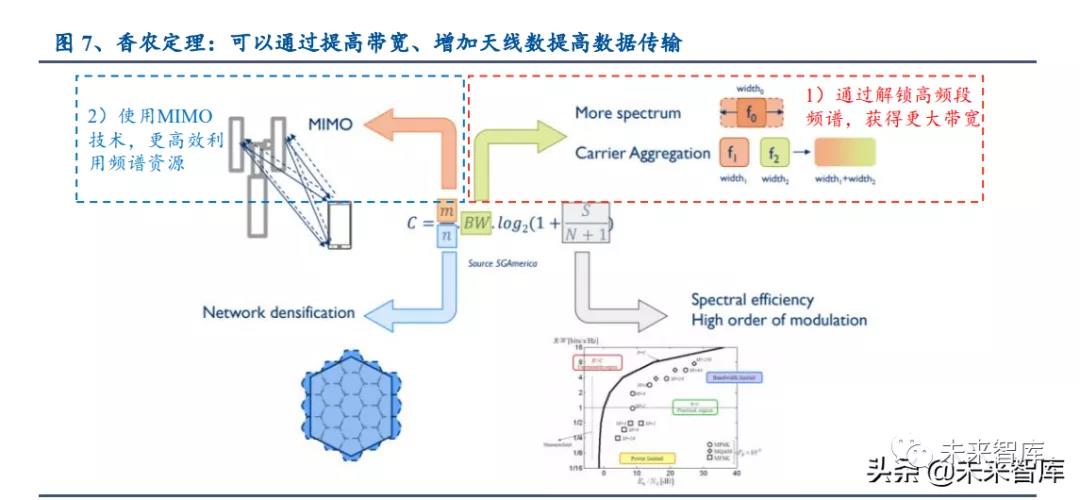

5G improves data transmission speed by widening the bandwidth and increasing the number of channels, and the new frequency band requires supporting RF front-end devices. The most significant change in the communication generation change from 2G to 5G is the increase in data transmission speed. According to Shannon's law, the main means to improve the data transmission speed include: (1) increasing the bandwidth BW (Note: the bandwidth refers to the frequency range occupied by the modulated carrier, that is, the difference between the upper and lower frequency limits, in Hz); (2) increasing The number m of receive/transmit channels; (3) Improve the signal-to-noise ratio SNR (ie S/(N+1), where S is the signal power (W) and N is the noise power (W)). Specifically in the 5G era, it is:

(1) Method 1: Increase the maximum bandwidth from 20MHz of 4G to 100MHz of 5G by unlocking the vast high-frequency band resources (ie, the newly added 5G frequency band); → Impact on the RF front-end: 5G mobile phones need to be backward compatible 2 In addition to the /3/4G/ frequency band, it is also necessary to add corresponding radio frequency devices to match the new 5G frequency band.

(2) Method 2: More efficient use of spectrum resources by increasing the number of channels → Impact on RF front-end: Compared with 1T2R (a small amount of 1T4R) in the 4G band, the 5G band will implement (under the NSA standard) 1T4R/(SA) Standard) 2T4R.

1.2.1 Two major methods for 5G speed-up: unlocking high-frequency resources to widen bandwidth and increasing the number of channels to improve transmission efficiency

The pursuit of faster transmission speed has driven the change of the communication era, and 5G will be officially unlocked in 2020. 1G was born in the 1990s, marked by the big brother launched by Motorola. 2G began in the early 20th century, and feature phones represented by Motorola and Nokia began to appear. The 3G era began with the launch of the iPhone 3G in 2008, and then smartphones that support mobile multimedia technology took the world by storm. The 4G era began in 2013. Faster transmission speed made the digital economy possible, and the mobile Internet began to penetrate from the consumption field to the production field (such as live video, mobile shopping, etc.). 5G will be turned on in 2020, and the higher speed will make the communication scene shift from the mobile Internet to the Internet of Things.

Three major application scenarios in the 5G era: eMBB, mMTC, and uRLLC. 3GPP defines the three major application scenarios of 5G as eMBB (enhanced mobile broadband applied to 3D/UHD video, i.e. mobile Internet scenarios), mMTC (mass machine-type communication applied to smart homes and smart cities, i.e. Internet of Things). scene) and uRLLC (ultra-reliable and low-latency communication for unmanned driving, mobile medical, industrial automation, etc., that is, the Internet of Things scene).

The first method to improve the transmission speed in the 5G era is to obtain more bandwidth by unlocking the vast high-frequency band resources.

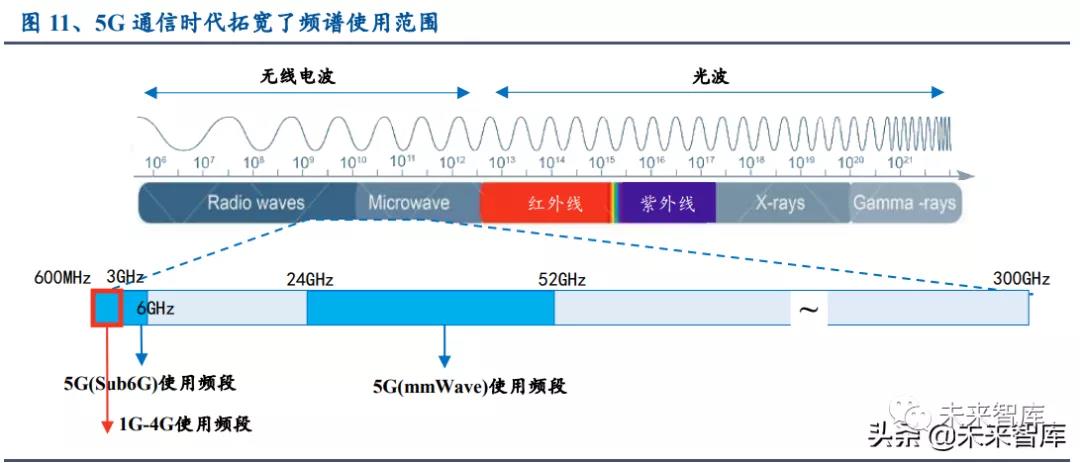

2G-4G mainly uses the 600MHz-3GHz frequency band, and 5G expands to the Sub-6GHz and millimeter frequency bands. Electromagnetic waves are electromagnetic fields that move in the form of waves in space by electric and magnetic fields, propagate at the speed of light in a vacuum, and are divided into light waves and radio waves according to the frequency (frequency range is 300KHz ~ 300GHz). Among them, radio waves are widely used in wireless communication fields such as broadcasting, mobile communication, meteorology, satellite communication, and navigation and positioning. In order to ensure that the spectrum resources used in different fields do not interfere with each other, the International Telecommunication Union (ITU) has promulgated international radio regulations to uniformly plan wireless frequency bands. At present, most of the low-band resources (600MHz3GHz) have been occupied by 1G-4G. 5G, on the other hand, has expanded spectrum resources to the Sub 6GHz frequency band (ie FR1 segment) and the millimeter-wave band (ie FR2 segment) through technological progress.

After the high frequency band is unlocked, the maximum bandwidth is increased from 20MHz for 4G to 100MHz for 5G. Among the two frequency bands unlocked by 5G, the FR1 frequency band has a total of 6GHz bandwidth available (note: 600MHz-3GHz is mostly occupied by 1G-4G), and the FR2 frequency band has a total of 249GHz bandwidth available (note: the millimeter band frequency range is 3-300GHz, excluding two Special frequency bands that cannot be used in the field of communication, oxygen absorption section 57-64GHz, water vapor absorption section 164-200GHz). And wider spectrum resources means larger bandwidth. Compared with the 4G single-carrier maximum bandwidth of 20MHz (through carrier aggregation (CA, Carrier Aggregation) can reach 40/60MHz), the 5G maximum bandwidth is increased to 100MHz.

Method 2 to improve transmission speed in the 5G era: Improve utilization efficiency by increasing the number of channels

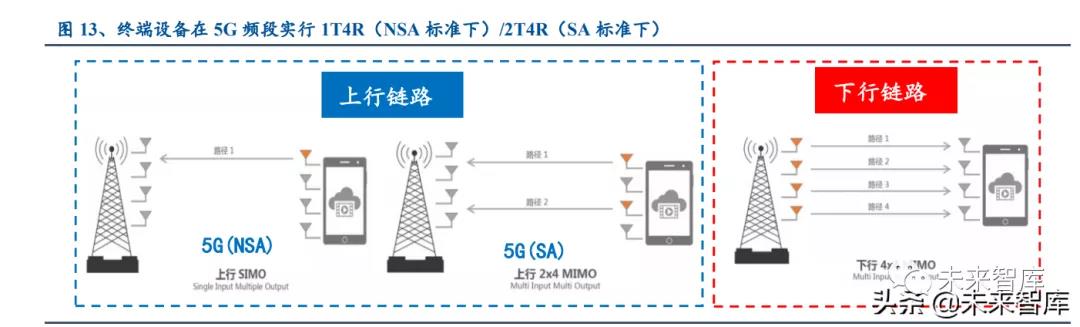

The terminal equipment adopts 1T4R (under NSA)/2T4R (under SA) in the 5G frequency band, while the 4G frequency band is only 1T2R. MIMO (Multi-input Multi-output) technology, that is, both the transmitter and the receiver have multiple antennas, and each sends/receives signals independently. There are three ways to improve the transmission rate: (1) spatial multiplexing, Different antennas transmit different information, which can be simply understood as laying a viaduct, which can double the transmission rate without increasing the bandwidth; (2) spatial diversity (spatial diversity), different antennas send the same information, so even one channel If the electromagnetic wave of the 1T2R is interfered, other channels can still receive information, thus reducing the possibility of simultaneous signal attenuation, and thus improving the signal quality. In theory, 1T2R can achieve a gain of up to 3dB; (3) beamforming (beamforming), by Multiple antennas create a directional beam that concentrates energy in the direction to be transmitted to increase signal quality. For terminal equipment, the 5G frequency band will no longer use the default 1T2R (a small amount of 1T4R) of the 4G frequency band, but will implement 1T4R (under the NSA standard) and 2T4R (under the SA standard). (Note: 1T4R means that the terminal device includes 1 uplink + 4 downlinks).

1.2.2 The new frequency band of 5G needs to be matched with the corresponding RF front-end devices

Due to the need to be backward compatible with old frequency bands, the change of communication generations means that the number of covered frequency bands is increased. To put it simply, if a 5G mobile phone is to be used on a global scale and under various operator networks, it needs to achieve full coverage of wireless communication frequency bands through multi-mode and multi-frequency, including (1) vertical dimension: backward compatibility 2 /3/4G frequency band, (2) Horizontal dimension: Compatible with different frequency bands of operators around the world. Taking the iPhone as an example, we can see that when the communication era evolves from 3G to 4G, the number of frequency bands supported by mobile phones has increased from about 10 frequency bands in the 3G era to about 40 frequency bands in the 4G era.

In the 4G era, high-end models cover nearly 40 frequency bands, and entry-level mobile phones cover more than 10 frequency bands. Generally, mid-to-low-end mobile phones are regional versions and support fewer frequency bands. Taking the different models of mobile phones released in the second half of 2016 as an example, the Xiaomi Redmi 4A supports less than 20 frequency bands, far less than the nearly 40 frequency bands of the iPhone 7 in the same period. In addition, we counted the number of frequency bands commonly used in the 4G era, including 25 4G frequency bands, 10 3G frequency bands, and 4 2G frequency bands.

In the 5G era, FR1/FR2 resources are developed, and the n77/n78 frequency band is currently the most widely used. The FR1FR2 spectrum resources for 5G were allocated at WRC-15WRC-19 (World Radiocommunication Conference 15/19). (1) FR1 segment resources: Since 2016, major countries/regions in the world have begun to allocate 5G spectrum, of which the 600/700MHz frequency band is used in some countries in Europe and the United States, while the n77 (3.3-4.2GHz)/n78 (3.3-3.8GHz) It is currently the most widely used spectrum for 5G NR, and n79 (4.4-5-GHz) is mainly promoted by China, Japan and Russia. (2) FR2 segment resources: WRC-19 has reached an agreement on the millimeter-wave spectrum allocation for IMT-2020 (5G), which will be conducted in the 24.25-27.5GHz, 37-43.5GHz, 45.5-47GHz, 47.2-48.2 and 66-71GHz frequency bands Divide.

China Mobile obtains the n41/n79 frequency band, and China Telecom and China Unicom use the n78 frequency band. The spectrum allocation plan of my country's three major operators was officially launched at the end of 2018. According to the plan, China Mobile obtained the 2.6GHz (n41) and 4.9GHz (n79) frequency bands, with a total bandwidth of 260MHz, and China Telecom/China Telecom newly obtained the 3.5GHz frequency band (n78). , 100MHz bandwidth respectively. China Among them, n78/n79 are newly added frequency bands, and the 2575-2635MHz (belonging to n41) frequency band is the re-cultivation frequency band of TD-LTE (4G) frequency band by China Mobile.

5G mobile phones generally support more than 5 5G frequency bands, and can support up to 17 5G frequency bands. We counted the current mainstream first-generation 5G mobile phones and found that in addition to supporting the three frequency bands of n41/n78/n79, n1/n3/n77 also covered more, and the OPPO high-end Find X2 pro even supports 10 5G frequency bands. In addition, according to mobile-related recommendations, 5G mobile phones need to add at least two frequency bands n78/n79, and it is recommended to add three frequency bands n1/n3/n41. According to the latest 3GPP Release 17, there are a total of 56 frequency bands in the FR1 frequency band under the 5G NR standard, and n78/n79 are currently the most widely used worldwide.

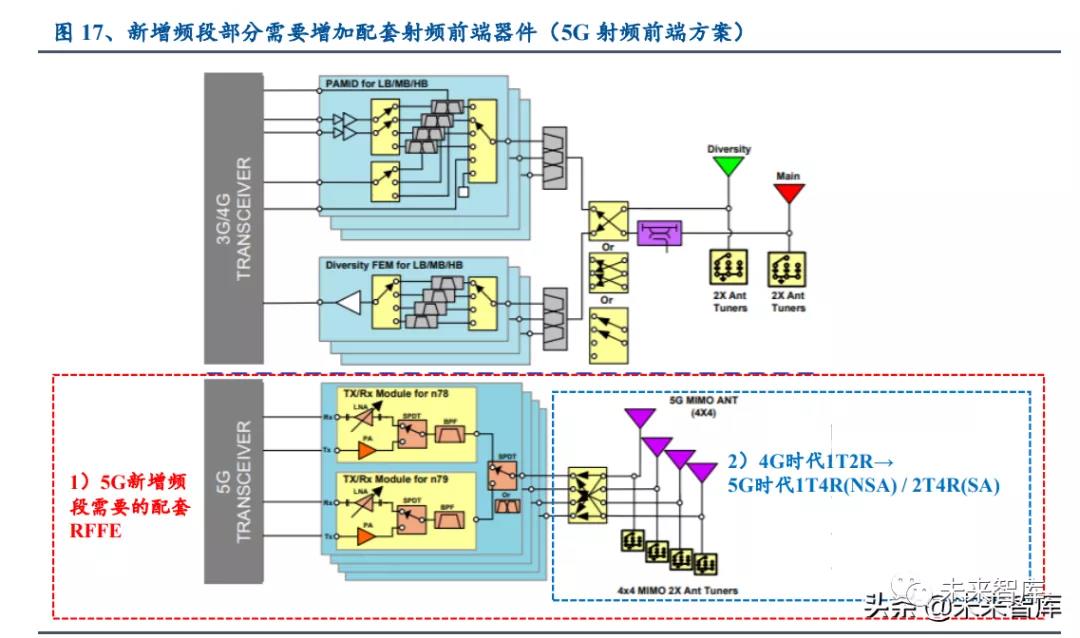

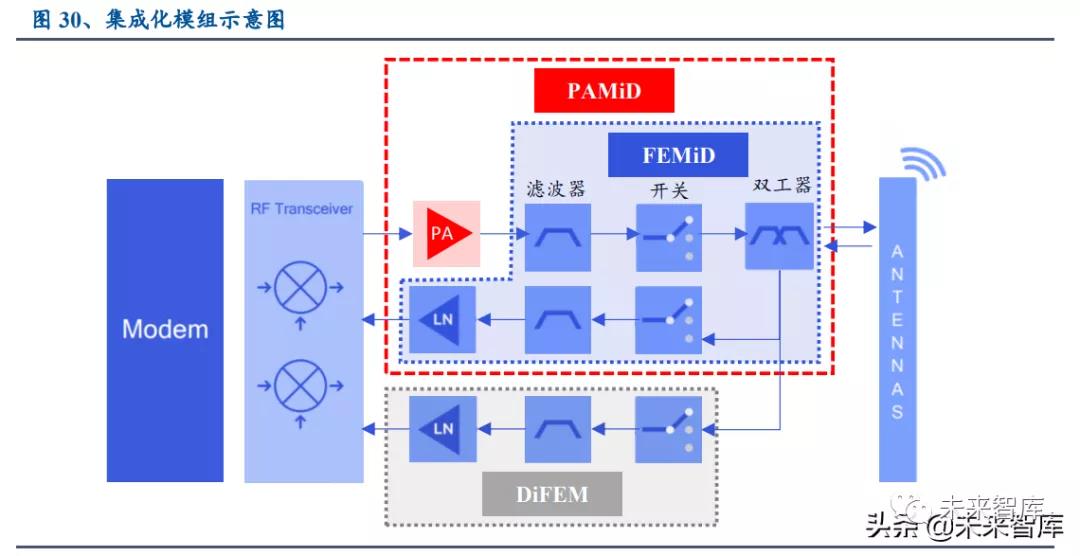

5G adds new frequency bands, and it is necessary to add RF front-end devices to support it. The current mainstream 4G RF front-end architecture mostly adopts TRX (receive path + transmit path) + DRX (diversity reception) to achieve 1T2R mode, and both TRX and DRX paths are implemented by integrated modules. Simply put, each frequency band is integrated into six to eight modules according to the frequency, namely GSM/LB/MB/HB PAMID modules and GSM/LB/MB/HB Diversity FEM modules. In the 5G era, at least two channels corresponding to the n78/n79 frequency bands need to be added, which are 1T4R under the NSA standard and 2T4R under the SA standard.

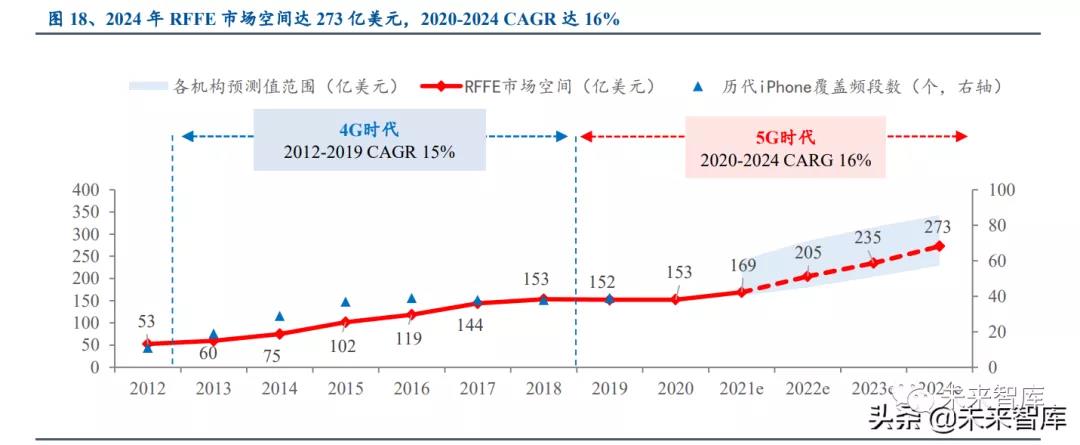

1.3 It is estimated that the RF front-end space will be 27.3 billion US dollars in 2024, and the CAGR will be 16% in 20-24

According to our forecast, the RF front-end market space will reach 27.3 billion US dollars in 2024, and the CAGR will reach 16% in 20-24. The last round of the RF front-end market started in the 4G era. The demand for full Netcom has greatly increased the number of frequency bands covered. The number of commonly used frequency bands has increased from about 10 frequency bands in the 3G era to about 40 frequency bands in the 4G era. The 2012-2019 CAGR was as high as 15%. The 5G era is officially launched in 2020. We predict that the RF front-end market space will reach US$27.3 billion in 2024, and the CAGR will reach 16% from 2020 to 2024. The increment mainly comes from the new frequency bands of 5G, which is US$11.3 billion.

2 The integration level is improved and the superposition technology is upgraded to continue to promote the innovation of RF front-end

Looking back at the iterative history of communication technologies from 2G to 4G, we can clearly see two parallel development paths for RF front-end manufacturers. Self-developed to obtain the layout of the entire product line, the second is to ensure that high-performance products can still be provided in the new generation through technological innovation.

2.1 Trend 1: Integration requirements drive the layout of the entire product line

Since the 3G era, in order to save PCB area and reduce the research and development difficulty of mobile phone manufacturers, the RF front-end has gradually shifted from discrete devices to modules. During this period, the passive device integrated product FEMiD (Front-end Module with integrated Duplexers) dominated by Japanese manufacturers was the mainstream (mainly integrated filters and switches), while European and American manufacturers continued to study active device PA products. However, with the advent of the 4G era, OEMs have a need for further integration of PA and FEMiD, namely PAMiD (PA Module integrated Duplexer) module, which promotes the merger and integration of active manufacturers and passive manufacturers, and has PA, filters and switches. The four major RF front-end giants in the entire product line, Qorvo, Skyworks, Broadcom (Avago), and Murata, were also born.

2.1.1 The inevitable demand under the continuous increase in the number of frequency bands covered: the improvement of integration

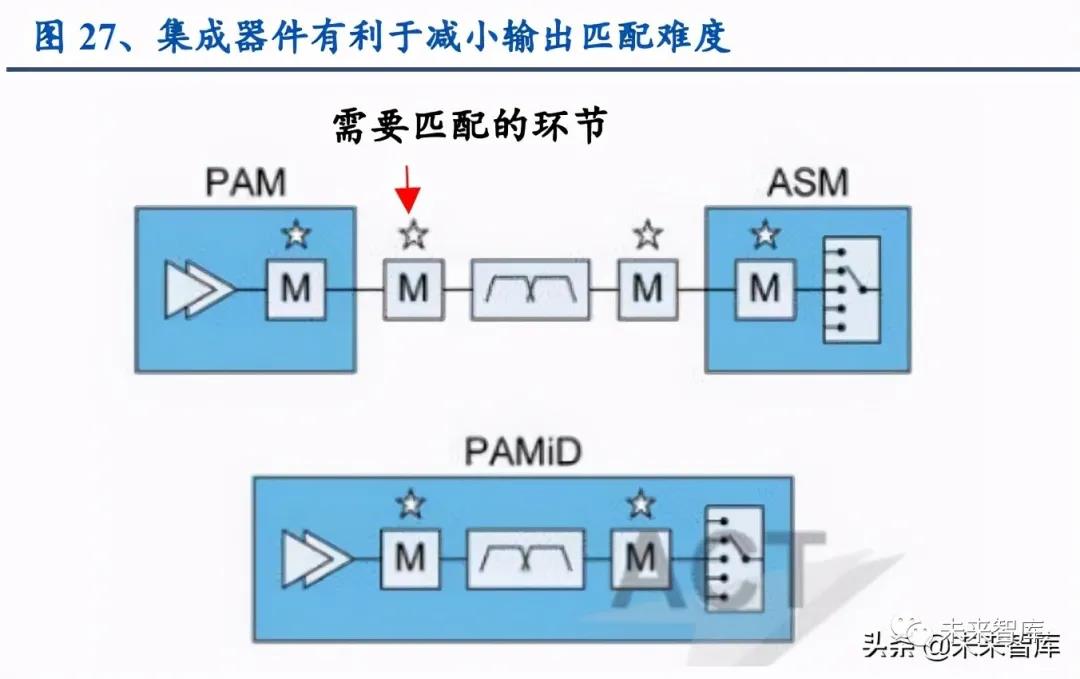

The number of frequency bands covered continues to increase, making mobile phone manufacturers need to integrate. We believe that the change in the demand of mobile phone manufacturers in the evolution of wireless communication technology is the main reason for RFFE to move from discrete devices to integration. (1) The number of frequency bands is increasing, but the PCB space is limited: when there are fewer supported frequency bands and fewer RFFE devices, the PCB reserves enough space for the RF front-end, even if discrete devices are used. However, since the 3G era, mobile phone manufacturers have launched multi-frequency and multi-mode models, so the limited PCB area has prompted the design of RFFE to be integrated. (2) Reduce the research and development difficulty of mobile phone manufacturers to shorten the development cycle of new products: As an active device, the heat consumption of PA will affect the work efficiency/linearity of the passive device filter, so it is more difficult to combine the PA and the filter. high. The integrated solution transfers the technical link from the mobile phone manufacturer to the RFFE supplier, which reduces the difficulty of matching the output of the PA in the research and development process of the mobile phone manufacturer, thus shortening the new product development cycle of the mobile phone manufacturer.

Because the RF front-end devices use heterogeneous materials, the integrated module takes the form of SiP. Unlike most semiconductor industries to improve performance by shortening the process, the improvement of RF front-end device performance depends on technological innovation. For example, PA uses the first-generation semiconductor Si+CMOS process in the low-frequency band, and the second-generation semiconductor GaAs+HBT process in the high-frequency band. Passive device filters include SAW and BAW technologies. Therefore, an important direction of RF front-end development is to integrate heterogeneous integration on a single chip, that is, using SiP packaging technology to put PA, filters, switches, etc. on a single chip.

From FEMiD modules in the 3G era to PAMiD modules in the 4G era. (1) 3G era: In this period, the demand for integration of mobile phone manufacturers was still low, and the mainstream RFFE often appeared in the form of PA+FEMiD (Note: FEMiD mainly integrates filters and switches). Since Japanese manufacturers have been deeply involved in the field of filters for many years, the integration of FEMiD is mainly promoted by Japanese manufacturers Murata, TDK, etc. (2) 4G era: The substantial increase in the number of frequency bands has increased the demand for integration again, and the output matching of PA and other devices is the bottleneck of integration. Therefore, this round of integration is dominated by European and American manufacturers Skyworks, Qorvo, Avago, etc. that master the core technology of PA. They combine MMMB PA (that is, a single PA device supporting multi-mode and multi-frequency) and FEMiD into a PAMiD module, and According to the frequency, it is divided into GSM/LB/MB/HB PAMiD, and the integrated form of the current mainstream mobile phone is gradually determined, that is, only three or four PAMiD chips can cover the whole frequency band.

Teardown comparison: Take the Samsung Galaxy series as an example to see the transition from FEMiD to PAMiD. Take the Samsung Galaxy S4 and Galaxy 10+ as an example: the Samsung Galaxy S4 in the 3G era includes a MMMB PA chip provided by Skyworks and FEMiD provided by Murata. The 4G product of the same series, the Galaxy 10+, is more integrated, consisting of an MB/HB PAMiD provided by Avago and a LB PAMiD chip provided by Murata.

The 5G-sub6 era may continue the integration mode of GSM/LB/MB/HB/5G PAMiD since 4G. Judging from the 5G mobile phones that have been released (taking Xiaomi Mi 10 and Samsung galaxy S20 as examples), the RF front-end still continues the collection method since 4G, that is, the 2G-4G frequency band is divided into three or four GSM/LB/MB according to the frequency band. /HB PAMiD, and the newly added 5G frequency band is solved with one to three PAMiDs alone.

2.1.2 Facing a highly concentrated customer base, RF front-end manufacturers provide two sets of integrated solutions: simplified version and full Netcom

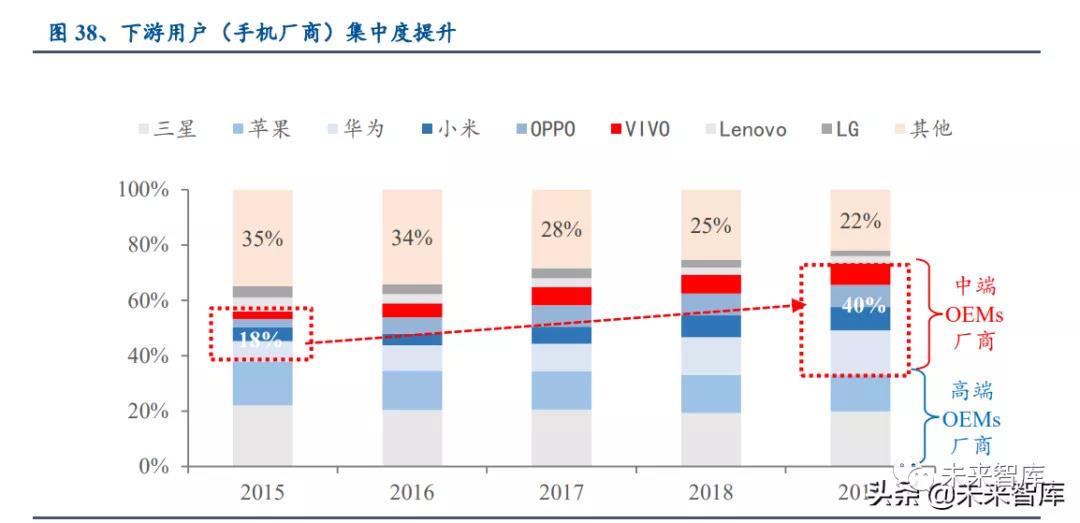

The 4G era has witnessed the rise of mid-range mobile phone manufacturers. Each new generation of new technology provides opportunities for latecomers to surpass, and the 4G era has witnessed the rise of China's mid-range OMEs: the combined market share of Huawei + Xiaomi + OPPO + VIVO increased from 18% in 2015 to 40%, while other The market share of manufacturers with small and medium shares was compressed from 35% in 2015 to 22% in 2019.

Facing a highly concentrated mid-end and high-end customer base, RFFE manufacturers have launched two targeted series of products. When the concentration of downstream users increases, customized products to meet specific users become less expensive. Therefore, RFFE manufacturers including Skyworks and Qorvo have successively launched two parallel series of high-end and mid-end products. For example, Skyworks has launched the Sky5 LiTE series and Sky5 Ultra series, which respectively meet the low-cost needs of mid-end users and the full Netcom needs of high-end users; compared with high-end line products, mid-end line products cover fewer frequency bands, mainly to meet the needs of regional wireless communication needs. Taking the mid-end product MB/HB PAMiD SKY5™-8095 as an example, it covers a total of 8 frequency bands for high frequency/intermediate frequency; while the corresponding high-end product MB/HB LPAMiD SKY5™-8265 covers 11 frequency bands. Similarly, Qorvo has also launched RF Flex and RF Fusion to meet the needs of mid-range users and high-end users respectively.

2.1.3 From distinction to merger and acquisition integration: the tide of mergers and acquisitions catalyzed by integration

The separation of the 3G era and the integration of the 4G era. In the 3G era, Japanese manufacturers dominated the passive device integration product FEMiD, while European and American manufacturers continued to study active device PA products. However, the arrival of the 4G era has broken the dividing line between active manufacturers and passive manufacturers. The need for further integration of PA and FEMiD has promoted the merger and integration of active manufacturers and passive manufacturers. It has a full product line of PA, filters and switches. The four major RFFE giants were also born:

New Murata = old Murata (focusing on SAW filters) + Renesas PA business + Peregrine's CMOS PA. Japanese company Murata is a leader in passive components with high-Q, low-loss SAW filters. Since the 4G era, Murata has successively acquired the PA business of Renesas in 2012 and the CMOS PA business of Peregrine in 2014, thus transforming into a full-industry-chain RF manufacturer integrating filters, PAs and switches.

New Skyworks = old Skyworks (PA legacy manufacturer) + JV with Panasonic (SAW filter). In the 3G era, Skyworks was less competitive than other European and American manufacturers Avogo and RFMD; however, since it entered the Apple supplier list in 2012 and launched the integrated product Skyone in 2013, the company began to enter the first echelon. In 2014, the company and Panasonic jointly established Skyworks Filter Solution, and completed its acquisition in 2016, thus making up for the lack of filters.

The new Broadcom(Avago)=transformed from Avago (mastering the PA and holding the BAW-FARB filter in hand). Avago was born out of the semiconductor division of the original HP. In 1999, HP spun off Agilent. In 2005, Agilent sold its I/O solutions division, which is now Avago. However, unlike other companies in the entire production chain, Avago's current product lines, PA and BAW-FARB, were not acquired through mergers and acquisitions.

New Qorvo = RFMD (focus on GaAs/GaN PA) + TriQuint (BAW-SMR filter). RFMD focuses on GaAs PA products and has GaN production capabilities; it used to be deeply bound with Nokia, but with the fall of Nokia, it lost a large market. TriQuint has BAW-SMR filter technology in addition to GaAs/GaN production capabilities. Therefore, in 2014, Qorvo, which was produced by the complementary integration of the two, continued to shine in the 4G era.

After the integration in the 4G era, the four giants have completed the layout of the entire product line. Through mergers and acquisitions in the 4G era, the four giants currently have major device production lines capable of producing PAMiD chips. In comparison, in the field of filters, Murata and Skyworks are better than SAW/TC-SAW filters suitable for low frequency bands, while Broadcom and Qorvo choose the BAW filter route; in the field of PA, mainstream manufacturers currently have the ability to produce high frequency bands. Suitable GaAs PA.

2.2 Trend 2: High-frequency trends are unstoppable, and new technologies emerge as the times require

The continuous unlocking of high-frequency resources requires RFFE to continuously introduce new technologies to ensure performance. Among them, we focus on the two "strategic battlegrounds" in the RF front-end, active device PA and passive device filter:

Technology 1: The performance improvement of PA is mainly through the combination of new materials and new processes, rather than shortening the process. The development law of digital chips such as memory chips and processors roughly follows Moore's Law, that is, the performance of the chip doubles every 18 months (that is, more transistors make it faster). Shrinking does not bring performance improvements and cost reductions: (1) The breakdown voltage decreases with size reduction, and for PAs, high operating voltages are required to provide high output power. (2) The overall size of the analog circuit does not shrink proportionally with the reduction of the feature size (such as the inductor), so under the advanced process, the cost per chip does not drop but rises. Looking at the past few generations of technology changes, we can see that the mainstream development path of PA is (1) terminal: from Si CMOS to GaAs HBT/GaAs HEMT; (2) base station: from Si LDMOS to GaN HEMT.

Technology 2: In the high frequency band, the filter is migrated from SAW technology to BAW technology. Similar to the challenges faced by PAs, filters also need to maintain high performance in higher frequency bands and wider bandwidths. In the 2G era, SAW filters were the mainstream technology, and Murata was the industry standard; however, since the 3G era, Japanese manufacturers' continuous research and craftsmanship has failed to achieve good performance in high frequency bands (including low insertion loss, high Q value, etc.), while European and American manufacturers represented by Qorvo and Broadcom have stepped onto the stage through high-frequency BAW filters that can still maintain high performance.

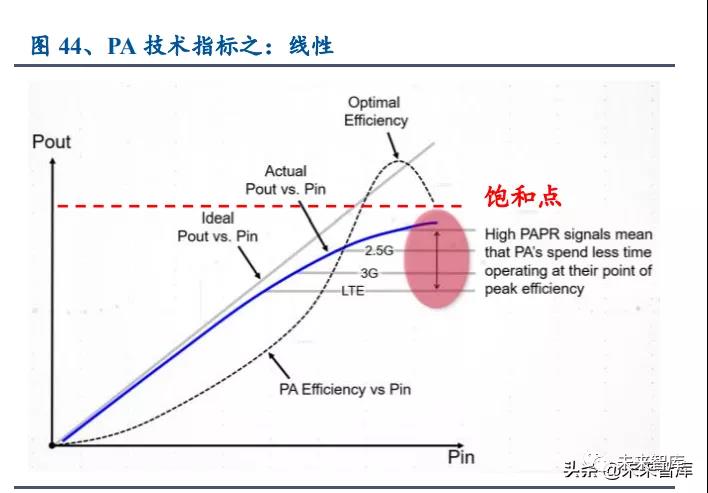

2.2.1 PA: In the high frequency era, GaAs/GaN continues to lead

The main design difficulty of PA: the balance between efficiency and linearity. The PA obtains energy from the power supply to increase the power of the output signal, that is, when the waveform of the output signal is consistent with the input signal, the amplitude of the output signal is increased. Its main technical indicators include: (1) output power, that is, how much output power needs to be achieved to ensure the transmission distance; (2) efficiency, that is, the ratio of output power to the power provided by the power supply, used to measure the power consumption under the same output power (3) Linearity, that is, the ratio of output power to input power, nonlinear distortion will generate new frequency components, causing interference to the transmitted signal. However, there is a contradiction that is difficult to reconcile between efficiency and linearity. Therefore, the balance between efficiency and linearity is the main problem that needs to be considered in PA design: (1) High efficiency requires high power output: efficiency is proportional to output power, and at the maximum output The highest efficiency (50%-60%) is achieved at high power; (2) Linearity cannot be guaranteed under high power output: when the input power is within a certain range, the output power of the power amplifier has a linear relationship with the input power, but when the input power increases When it reaches a certain value, the output power does not continue to increase, that is, it tends to saturate the output power.

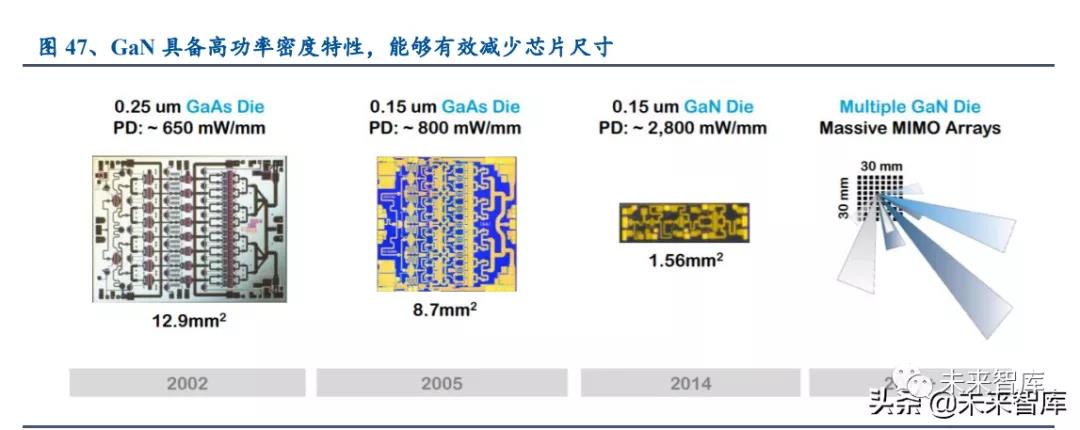

The unlocking of high frequency bands pushes GaAs/GaN with higher saturation electron speeds to the stage. In the process of evolution from 2G to 5G in the communication era, the increase in the difficulty of PA design mainly comes from: how to maintain high performance (mainly linearity, efficiency, output power, etc.) at higher operating frequencies. Compared with the current mainstream semiconductor material Si (accounting for about 95% of the market), (1) the second and third generation semiconductor materials GaAs and GaN are more suitable for high-frequency working environments: the working frequency of the semiconductor is positively related to its saturation electron migration speed, Therefore, GaAs and GaN materials are more suitable for high-frequency working environment. (2) Compared with GaAs, GaN is more suitable for high power output: GaN, as a wide bandgap material (that is, the band gap is as high as 3.4eV), has a higher breakdown voltage, so it is more suitable as a high power output material.

5G era sub-6GHz segment: terminals continue to use GaAs, and base stations switch from Si LDMOS to GaN. The physical properties of a material determine its performance in different working environments. Considering the two aspects of output power and operating frequency, we can see that the material + technology of PA presents the following trends: (1) Terminal (mobile terminal): In the 2G era, low-cost Si CMOS is the main process; starting from 3G, GaAs HBT has become the mainstream material. Compared to GaN, GaAs has a maximum power level of no more than 5W, so it is more suitable for end equipment (the power range on the mobile phone is about 27.5 to 28 dBm, or 0.4 to 0.5 W). (2) Base station: Since the 4G era, GaN has gradually been commercialized; in the 5G era, it has become an industry consensus that GaN will gradually replace Si LDMOS.

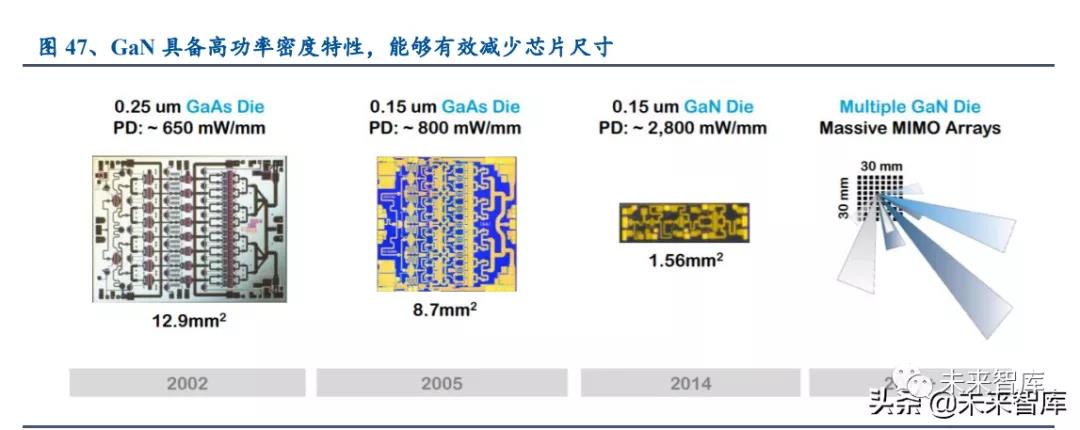

Millimeter band in the 5G era: multiple solutions for terminal GaAs, GaN, and lnP are in parallel. At present, there is still controversy about the selection of terminal materials in the millimeter wave band. There are several parallel research schemes for GaAs HEMT, lnP HBT, and GaN in IDM manufacturers. Compared with GaAs, GaN has higher power density and higher cut-off frequency, which can effectively reduce the number of transceiver channels and chip size, and is expected to become a solution for terminal equipment. For example, Qorvo has launched a GaN module QPF4006 that integrates PALNA switches, which is suitable for 5G base stations and terminals at 39GHz; its transmission channel provides 23dB small signal gain and 2W saturated output power, and the package size of 4.5mm×4.0mm can meet the phase Tight lattice spacing requirements for array applications.

For cost reasons, GaN devices mostly use SiC/Si as the substrate. Due to the high cost of using homogeneous materials as substrates, GaN mostly uses heterogeneous substrates, including: GaN-on-sapphire (the main technology of LED), GaN-on-SiC, GaNon-silicon, of which the latter two The alternative is the RF front-end. The thermal conductivity of GaN-on-SiC is three times that of GaN-on-Si, allowing devices to operate at higher voltages and higher power densities, so most commercial GaN RF devices in the industry currently use this process.

2.2.2 Filters: In the 5G era, BAW filters perform better

The main technical indicators of the filter: quality factor Q value and insertion loss. The filter conducts specific screening of frequency bands through the combination of capacitors, inductors, and resistors. The frequency range where the signal is not significantly attenuated is called the passband, and the area where the signal is significantly attenuated is the stopband. The position of attenuation 3dB (ie The frequency corresponding to the power attenuation of about 50%) is called the cutoff frequency. The main indicators used to measure the performance of the filter are (1) Insertion loss measures the degree of signal attenuation: Insertion Loss (Insertion Loss) refers to the attenuation of the original signal in the circuit due to the introduction of the filter, with 10lg (Po/Pi) Calculation (Po is output power, Pi is input power), in dB, so the lower the insertion loss, the lower the power consumption. (2) Q value measures selectivity: Q value (Quality factor, quality factor) is the ratio of the center frequency of the filter to the -3dB bandwidth, which is used to describe the filter's ability to distinguish adjacent frequencies. The wider the bandwidth of the filter, the higher the Q value, the narrower the bandwidth of the filter, the more "selective".

The acoustic filter filters the frequencies during the conversion process of "electrical→acoustic→electrical". When a voltage is applied to the crystal, the crystal will undergo mechanical deformation, converting electrical energy into mechanical energy; conversely, when the crystal is mechanically compressed or stretched, charges are formed on the opposite side of the crystal structure, allowing current to flow into the terminals and/or form between the terminals. Voltage. And the acoustic filter, it is in the process of electric→acoustic→electrical conversion, the frequency is screened. There are two ways for sound waves to propagate in solids, one is bulk acoustic wave (that is, transmitted inside the solid in the form of longitudinal or transverse waves), and the other is surface acoustic wave, corresponding to BAW (bulk acoustic wave filter) and SAW (Surface acoustic wave respectively). , surface acoustic wave filter).

The current mainstream acoustic filters include SAW and BAW. (1) SAW filter: It consists of a piezoelectric substrate and an interdigital transducer (IDT) covered on both sides. The former is mainly made of quartz, lithium tantalate (LiTaO3) or lithium niobate (LiNbO3), etc.; the latter is a comb-like metal layer used to realize the conversion of electricity to sound and sound to electricity. When a sound wave propagates along the surface of an elastic material, its amplitude decays exponentially with depth into the surface. (2) BAW filter: The piezoelectric substrate (piezolayer) is made of quartz crystal, and there are metal electrodes (Electric port) on the upper and lower sides. The metal sheets on the top and bottom of the quartz excite sound waves that bounce back and forth between the patch and the crystal, oscillating within the piezoelectric film to form standing waves. According to the different ways of capturing and dissipating sound energy, BAW filters can be divided into SMR (solid-body bulk acoustic wave filter) and FBAR (film bulk acoustic wave filter).

Sub-1GHz SAWs offer cost advantages, and 1 to 6GHz BAWs offer better performance. (1) SAW filters have cost advantages, but poor high-frequency performance and sensitivity to temperature changes: Since SAW filters are assembled on wafers, they can be mass-produced at low cost. However, its working principle determines that the higher the frequency, the smaller the IDT spacing, which makes it perform poorly in the frequency band above 1GHz, and can only support the 2.5GHz frequency band. In addition, the performance of the SAW filter will deteriorate with the increase of temperature. For this, Murata has added a protective coating on the IDT (ie TC (temperature compensated)-SAW filter), and its performance and price are between BAW and SAW between. (2) BAW has better high-frequency performance and is not sensitive to temperature changes: BAW filters are more expensive, but because their sound energy density is very high, and they can capture sound waves more effectively, they have lower insertion loss. High-frequency performance is better; in addition, it has the advantage of being smaller and less sensitive to temperature. BAW can currently handle frequencies up to 6 GHz.

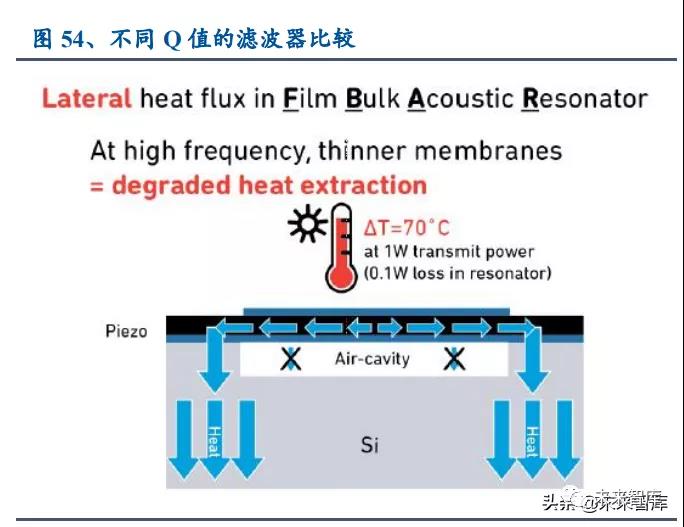

Compared with the two BAW filters, the heat dissipation of SMR is better than that of FBAR, which is suitable for the high power output required by high frequency bands. As the operating frequency increases, the signal attenuation will also increase, so the filter needs to support high-power RF signals to ensure long-distance transmission, so heat dissipation is extremely important in high frequency bands. One of the basic differences between FARB and SMR is its thermal conduction path: SMR has a thermal conduction path leading to the substrate and dissipates heat through the substrate; while in FARB, because there are air gaps on each side, the thermal conduction path is relatively small. weak. So per watt of transmit power, SMR is 20°C higher and FBAR is 70°C higher.

In the 4G era, the value of BAW in the filter accounts for 40%-50%. According to statistics, the average number of SAW, TC-SAW, and BAW filters per 4G mobile phone is about 30+/10/20, respectively. On the whole, BAW filters are used less, but due to their high price, the value of BAW in 4G mobile phones accounts for nearly half; taking a regional and full Netcom mobile phone as an example, the value of the stand-alone filter is 4/7.25 respectively. USD, of which the value of BAW filters accounts for 40%-50%. Figure 55. Number of stand-alone filters (pieces/unit) Figure 56. Value of stand-alone filters

The high-frequency filtering and large bandwidth of 5G Sub6 pose higher challenges to performance, and BAW filters are still the first choice. Compared with the 4G frequency band, the sub-6 frequency band of 5G has a larger bandwidth and higher frequency. At the same time, the n79 frequency band is close to the 5GHz WIFI frequency band, and only 150MHz apart in the middle. Therefore, the filter needs to be suppressed in high bandwidth and high adjacent band. Balance between the two, and the current 5G sub6 frequency band is still the first choice for BAW filters.

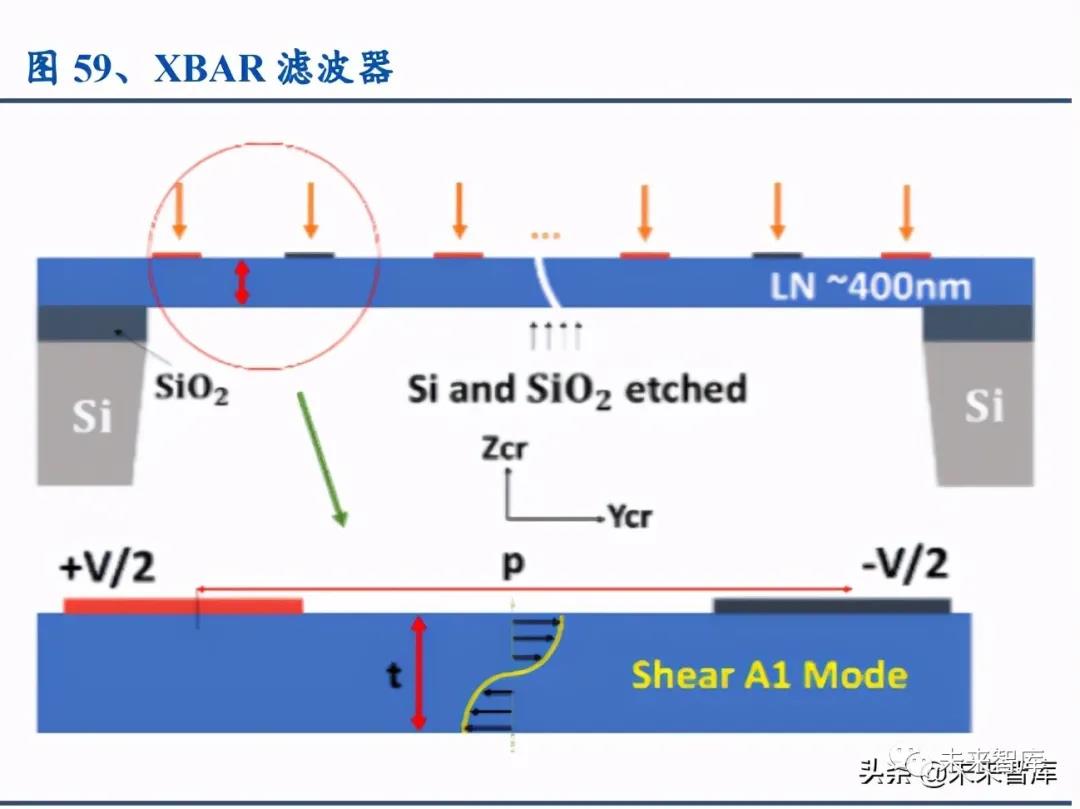

The technical route of 5G millimeter wave band is still inconclusive, including LTCC, XBAR and other technologies are still under development. The current applicable range of FBAR and SMR technology is still mainly below 6GHz. Due to higher frequency filtering (24GHz-52GHz) and larger bandwidth (up to 1GHz or more vs 100MHz of 5G sub6), the millimeter wave band has put forward a better performance of the filter. High requirements, there is currently no deterministic technical route. Current potential mmWave technologies include (1) TDK's first LTCC filter product for the 28 GHz band in 2019/11, (2) Resonant's first XBAR filter in October 2018, according to ISN simulations , which has commercial potential at 28 GHz, and in October 2019 Murata has signed a multi-year commercial agreement with Resonant for XBAR technology.

3 The four giants share 80% of the market, with differentiated product layouts and competition in different frequency bands

3.1 The four giants share more than 80% of the market, and there are differences in the layout of each product line

3.1.1 The growth path of giants has the same goal

The integration requirements arising from the 4G era have led to the current mainstream manufacturers to carry out a full product line layout, but the development paths of the four giants are not the same.

Murata: A typical Japanese company, with ingenious craftsmanship to create an industry benchmark for SAW filters. Murata started with passive device filters and inductors. After 2005, it expanded its product line through a number of acquisitions, and acquired the PA product lines of Renesas and Peregrine in 2012/2014, but the company's core profitable products are still its passive products. device. Unlike the other three giants, Murata is a typical Japanese company that relies on ingenious craftsmanship and advanced technology to compete with its peers. For example, in the era of broadband and high frequency bands, Avago/Qorvo launched BAW filters in a different way, but Murata still chose to study SAW filters. Therefore, in the field of SAW filters, Murata still has no one to match it with its high technology and low cost.

Skyworks: With profound accumulation of PA technology, in the 3G era, it has entered the first-line stage through cooperation with Apple. Skyworks was formed in 2002 by the merger of Alpha, which specializes in diodes, and Conexant's wireless communications division, while Conexant split off the semiconductor division of Rockwell Corporation, which started from California's military products (mainly the space shuttle), so its PA technology is actually Inherited Rockwell's profound accumulation in the field of military industry. However, before the 3G era, Skyworks mainly relied on low-cost supply to mobile phone manufacturers with a small share to survive, which was tepid; but from the 3G era, it began to emerge because it entered the Apple supply chain and became a first-tier RF manufacturer in one fell swoop. Today, Skyworks is still the most dependent RF manufacturer on Apple. In fiscal 2019, Apple's contribution to the company's operating income accounted for Skyworks 51% > Qorvo 32% > Avago 20%.

Qorvo: RFMD and TriQuint join forces to achieve complementarity and seize the integration needs of the 4G era. Qorvo was formed by the equal merger of RFMD, which ranked second in the RF front-end market at the time, and TriQuint, the third. Due to the different product focus of the two companies, the merger of Qorvo achieved complementary products. (1) RFMD's GaAs is its traditional strength: RFMD has been focusing on the wireless communication market since its establishment, and has ranked first in the GaAs device market by virtue of its in-depth cooperation with Nokia. Although in the 3G era with the fall of Nokia, its market share in GaAs devices dropped rapidly from 20% in 2008 to 12.4% in 2011, but in the 4G era, it stabilized the first echelon through the complementary alliance of TriQuint. s position. (2) TriQuint has BAWSMR technology: In addition to TriQuint’s production capacity of III and V compounds, it also acquired BAW filter technology through the acquisition of TFR Technologies in 2005, which makes Qorvo one of the current two heroes in the field of BAW filters.

Broadcom (Avago): After ten years of sharpening a sword, FBAR technology has become its unique stunt. Avago was born out of the semiconductor division of the original HP. In 1999, HP spun off Agilent, and in 2005 Agilent sold its I/O solutions division, which is now Avago. Its exclusive FARB technology originated in the Agilent period. After 10 years of research, the company successfully developed a FBAR filter applied to the PCS 1900MHz frequency band in the United States in 1999, and started mass production in 2001. Since then, the market share has been above 50%.

3.1.2 The overall strength is similar, but there are differences in product layout

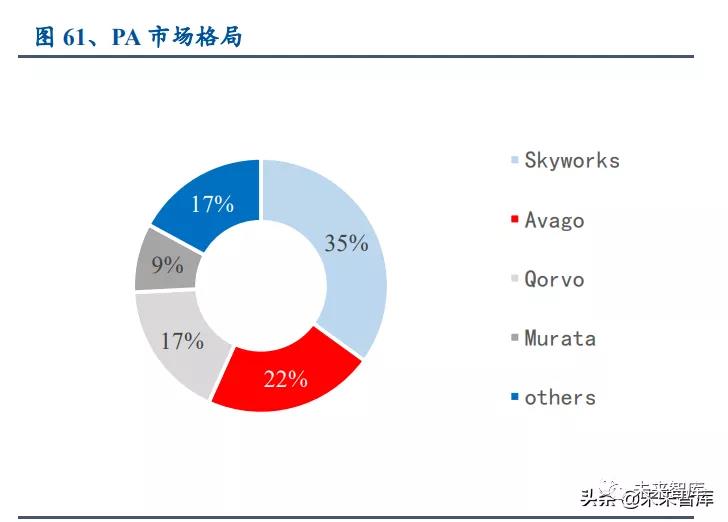

The four giants have the same overall strength, but the difference in filter layout makes the module positioning different. (1) On the whole, the four giants have the same strength, with a market share of 20%-24%; the remaining market is divided by the Japanese manufacturers TDK, Taiyo Yuden, and the newcomer Qualcomm from the baseband side. (2) From the perspective of product line, the PAMiD route set in the 4G era has caused the four major manufacturers to lay out various product lines, but there is a big difference in the filter technology route: the old filter manufacturer Murata still has SAW filters. Absolute advantage, with a market share of more than 50%. Avago and Qorvo, which have newly entered the filter market, have taken the lead in the field of BAW filters through the new FARB/SMR technology, respectively, with a market share of 56%/38%. Skyworks, on the other hand, has a slight shortage of filters because the layout of the filters is more than ten years later than that of Qorvo/broadcom. At present, although SAW/TC-SAW filters have independent production capacity, some products are still outsourced to Taiyo Yuden. In addition, Qorvo and Skyworks have greater advantages in the LNA and switch market, with a market share of 35%/23% respectively, while the domestic manufacturer Zhuoshengwei LNA and switch market share also reached 8%.

Due to differences in product layout, Skyworks/Murata mainly competes for low-band products, and Avago/Qorvo competes for high-band products. We counted the previous generations of iPhone and Galaxy S series products, and we can see that Murata/Skyworks mainly provides GSM/LB PAMiD, and Qorvo/Avago mainly provides MB/HB PAMiD. The difference in the competing frequency bands is ultimately due to the differences in the layout of each product: (1) Low frequency band: Murata mainly focuses on SAW filters, Skyworks acquires SAW/TC-SAW technology through the acquisition of a joint venture with Panasonic, and integrates BAW demand Outsourcing, so these two manufacturers mainly focus on the low-band GSM/LB track with lower technical requirements and higher cost control requirements. (2) Middle and high frequency band: Qorvo/Avago has a significant advantage in MB/HB due to its breakthrough in the development of BAW filters in the filter field.

3.2 Revenue Analysis of the Big Four

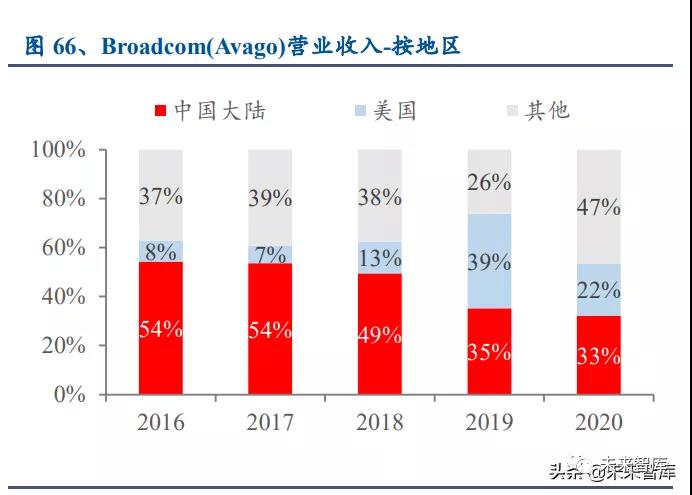

Broadcom/Qorvo/Skyworks RF devices each have annual revenues in excess of $2 billion. We have conducted statistics on the revenue of three European and American RF manufacturers in recent years, and their operating revenue of RF devices on the mobile phone terminal is more than 2 billion US dollars. Among them, Skyworks and Qorvo are mainly engaged in RF front-end devices for mobile phones, accounting for more than 70% of their revenue, and other revenue is mainly IoT-related RF devices. The RF device business of Broadcom, a semiconductor manufacturer with a wide range of categories, is only one of its divisions, so it accounts for a relatively small proportion, accounting for 9.7% of revenue in 2019.

Murata and Taiyo Yuden have similar revenue structures, both involving the field of communications, including filters, capacitors and other products. In terms of product types, both Murata and Taiyo Yuden focus on modular products (mainly filters) and other devices (mainly capacitors). USD), accounting for 30% of total revenue, and other device revenue of 1,143.5 billion yen (about 10.4 billion U.S. dollars), accounting for 70% of total revenue. From the perspective of product application, about 50% of Murata's total revenue comes from the communications field, with revenue of about 804.9 billion yen (about 7.3 billion US dollars) in fiscal 2021.

4 Domestic substitution: the road is long and the road is coming

4.1 The emergence of domestic manufacturers, the evolution from a single product to a modular

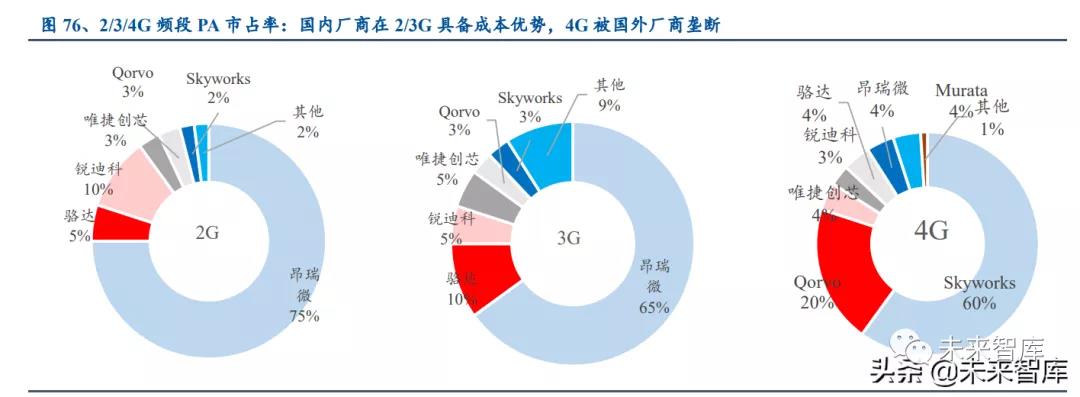

Domestic manufacturers have evolved from single products to modular products, and there is still room for improvement in layout and performance. From the perspective of the development path of overseas manufacturers, mainstream manufacturers generally first achieve the industry leading level in a single device (PA or filter), and then complete the transformation from discrete devices to modular products through mergers and acquisitions. From the perspective of development path, domestic manufacturers are also gradually evolving from a single product to a modular product, mainly including three types of manufacturers. (1) PA manufacturers: start from the 2/3G frequency band, and gradually penetrate into 5G, including Onray Micro, Weijie Chuangxin (acquired by MediaTek), Feixiang Technology, Diric (acquired by Spreadtrum), etc. Among them, Onray Micro The global market share on 2G/3G is 75%/65% respectively. In addition, we see that PA manufacturers have taken the lead in modularization, launching modules such as FEMPAMiDPAMiF, but the RF module products are still relatively rudimentary. Taking OnMicro as an example, the frequency band used by the company's 5G PAMid is 4G heavy. The 5G PAMid technology does not involve the high-frequency band. (2) Filter manufacturers: including Microgate Technology (a first-tier manufacturer of mobile phones in China, in-depth cooperation with CLP 26), Xinwei Communication (in-depth cooperation with CLP 55 on SAW), Wuxi Haoda, Northwest Wait. (3) Other devices: For example, the RF leader Zhuosheng Micro, the platform companies Weir shares, and Awinic Electronics, cut in from the LNA RF switch, and expanded to other devices and modules.

4.2 Domestic substitution, grasp the technical breakthrough and modular layout of PA and filter

4.2.1 Zhuoshengwei

Domestic RF switch/LNA leader, expanding to integrated modules. The company mainly produces radio frequency switches based on 12-inch 65nm RF SOI process and LNA based on SiGe and CMOS processes. At present, the RF switches and LNAs produced by the company can meet the application requirements of the sub-6GHz frequency band in 5G, and have achieved full coverage of TOP companies in the Android camp. At the same time, the company has also reached a cooperation intention with Qualcomm, and the RF switch has passed Qualcomm's small batch trial production verification and officially entered mass production. In addition, in order to comply with the trend of integration, the company began to launch related modular products, including DiFEM (diversity receiving module products), LFEM (LNA/filter integrated module), and LNA bank (multi-frequency multi-mode LNA integrated module).

4.2.2 Weir Shares

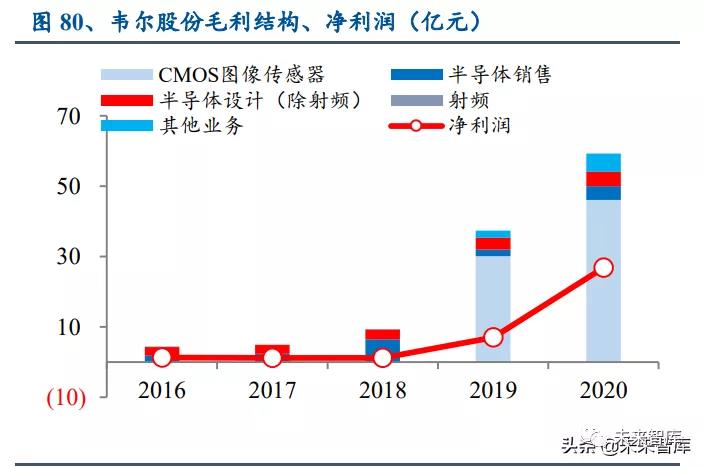

A platform-based company, starting from switches and LNAs. With the main business CIS as the core, the company is also committed to TDDI, analog, RF, etc., and is committed to building a platform-based enterprise. In recent years, the company has continuously invested in enriching the types of self-developed products of the company. By investing in Wuxi Zhongpuwei and Shanghai Weijue, the company has increased its investment in product research and development in the field of radio frequency. The result of market competitive advantage.

4.2.3 Sanan Optoelectronics

Develop third-generation semiconductors to provide foundry for PA and filter manufacturers. Sanan Optoelectronics is a leader in the production of LED epitaxial wafers and chips. Its LED business has a global market share of 20% and a domestic market share of 29%. In 2020, the operating income will be 8.5 billion yuan and the net profit will be 1 billion yuan. Its wholly-owned subsidiary, San'anji, was established in 2014. It mainly provides compound semiconductor wafer foundry services. Its process capabilities cover products in four fields: microwave radio frequency, power electronics, optical communication and filters. It has obtained important domestic customers. In 2020, it achieved sales revenue of 974 million yuan, a year-on-year increase of 305%; among which, important customers of GaN radio frequency products have achieved mass production, and the production capacity is gradually climbing; in addition, its filter product production line is continuously expanding and stocking In 2020, shipments will be realized.

4.2.4 Awinic Electronics

Deeply cultivate audio power amplifiers and power management chips, and expand the development of RF front-end chips. The company has been deeply engaged in the field of digital-analog mixed-signal, analog and radio frequency chips for many years. Starting from audio power amplifier chips and power management chip products, it has successively expanded and developed products such as radio frequency front-end chips and motor drive chips. In 2020, the company achieved revenue of 1.43 billion yuan and gross profit of 460 million yuan; of which the RF front-end was 101 million yuan, and the gross profit was 18 million yuan.

5 Risk Warning

(1) 5G mobile phone shipments are lower than expected: We expect the market space corresponding to the 3/4G frequency band to remain around US$14 billion, while the market space corresponding to the 5G frequency band will grow to more than 10 billion in 2024. If affected by the epidemic and lack of cores, 5G mobile phone shipments may be lower than expected.

(2) The technological progress of domestic manufacturers is slower than expected: RF front-end integration is a major trend, while domestic manufacturers mostly cut in from LNA, switches and other links. To achieve module shipments, they still need to be implemented in filters and PA products. breakthrough.

The "Kinghelm" trademark was originally registered by the Golden Navigator Company. Golden Navigation is a direct-selling manufacturer of GPS antennas and Beidou antennas. It has a very high reputation and reputation in the Beidou GPS navigation and positioning industry. Its research and development products are widely used in bds satellite navigation and positioning wireless communications, etc. field. The main products include: RJ45-RJ45 network, network interface connector, RF connector adapter cable, coaxial cable connector, type-c connector, hdmi interface type-c interface, pin header, SMA, fpc, FFC Antenna connector, antenna signal transmission waterproof connector, hdmi interface, usb connector, terminal terminal line, terminal board terminal block, terminal block, radio frequency rfid label, positioning and navigation antenna, communication antenna antenna cable, glue stick antenna suction cup antenna, 433 antenna 4G antenna, GPS module antenna, etc. Widely used in aerospace, communications, military, instrumentation and security, medical and other industries.

This content comes from the Internet/Xingyan Capital. This website only provides reprints. The opinions, standpoints, technologies, etc. of this article have nothing to do with this website. If there is any infringement, please contact us to delete it!

Copyright © Shenzhen Kinghelm Electronics Co., Ltd. all rights reservedYue ICP Bei No. 17113853