Service hotline

+86 0755-83975897

Release date:2021-12-29Author source:KinghelmViews:2434

In September 2020, Li Ping, former investment manager of national large fund, appeared again in the office of an external agent factory of SMIC. This factory has an 8-inch wafer production line, mainly engaged in sensor OEM. The major shareholder is the local government, "which is equivalent to the investment of the local government and the technology of SMIC".

Three months since Li Ping's last visit, the company's valuation has increased by 50%. The CFO of the foundry, who takes into account the financing affairs, is too busy to read the accounts. Sometimes he meets with four groups of investors a day. This is completely different from his previous rhythm in the animal husbandry company.

Maybe I have seen too many investors. The CFO can tell the company's valuation and production scale more professionally. Dozens of business cards are no longer scattered on his desk. Four stacks of business cards are neat, about 15 cm thick. It is estimated that there must be thousands of business cards for visiting investors.

Chip manufacturing is a very difficult business. Over the past five years, Samsung and TSMC have basically invested more than $10 billion in manufacturing capacity every year. SMIC, which has lost money for 20 years, is still far away from them. At present, SMIC has not started mass production of 14 nm chips. TSMC has loaded 5 nm chips into iPhone 12 and started testing 2 nm technology.

However, when it was listed in July, SMIC still became the largest IPO of a shares in recent 9 years, suffering 566 times oversubscribed. Its affiliates have also attracted much attention.

A chip listed company Trading Fund (ETF) managed by Huaxia Fund was listed in February this year. For more than half a year, its market value has ranked 15th in China (excluding Monetary Fund), only lagging behind some index or bond funds that have always been huge.

In 2015, more than 100 listed companies sold houses across borders, and now there are jokes about real estate bosses making chips. According to tianyancha data, 13000 enterprises expanded their business scope to integrated circuits in the industrial and commercial registration information in the third quarter of 2020 alone.

Even, enterprises do not need to hype the chip concept. Recently listed golden dragon fish received an investor's question is "does your company have semiconductor business?"

The enthusiasm for chip investment is transmitted from the secondary market back to the primary market, which in turn promotes the accelerated listing of start-ups.

Full of investors in a football field

At a chip investment forum in 2019, some investors lamented that people who invested in chips 10 years ago could sit at two tables, and there was only one table five years ago, "there must be thousands of people who can fit a football field now."

Past main investmenteliminateFunds in the Internet and other fields basically have the opportunity for investors to focus on chips。According to the data of Qingke private equity, from January to October 2020, there were 345 semiconductor projects invested by VC / PE in China, 10% less than that in the same period last year.However, the financing scale increased greatly, reaching 71.13 billion yuan in the first October, 2.5 times that of the same period last year.

Surrounded by hot money, the number of entrepreneurs in the chip industry has increased significantly. Chen Datong, founder of Spreadtrum, a chip design company, once mentioned that when Spreadtrum was first established in the early 2000s, there were only single digit chip design companies in China. After 2005, there were five or six hundred, and now there are more than 2000, while there have never been more than 100 in silicon Valley.

Chips were not considered good business. Chips burn too much money, and compared with the consumer industry with a market size of trillions of dollars, the ceiling of chip companies for enterprise sales is also lower. Bai Zongyi, Yao Tao capital partners, believes that there is a bubble in the company's creative board. The chip companies listed in China that make over US $10 billion are very challenging.

However, the trade conflict between China and the United States has pushed the chip to the front step by step, and the responsibility of China chip is becoming greater and greater. Chip is the product with the largest import expenditure in China, far exceeding crude oil. In 2019, China imported 305.5 billion US dollars of chips and 238.7 billion US dollars of crude oil. Only Huawei, Lenovo, bubagao and Xiaomi purchased more than 20% of the chips. According to Guosen Securities, if all semiconductor imports are localized, China's total GDP will increase by 3.2%.

Under the trend of domestic substitution and self-control, the investment fever caused by a chip is also spreading.

"Dream" scientific innovation board

The turning point of chip investment fever occurred on May 16, 2019. Huawei was included in the entity list by the U.S. Department of Commerce and was unable to sign new orders with U.S. chip companies. Turning to domestic chip suppliers has become a top priority for Huawei and other companies.

"This is a choice without choice", commented Cheng miaoqi, partner of Qingsong fund. According to Gartner data, Huawei spent more than $21 billion on chip procurement in 2018, the third largest chip buyer in the world.

On the same day a year later, the US Department of Commerce banned Huawei from using US technology and software to design chips, and the chip fever reached its peak.

On the other hand, the market sentiment is high, and the market value ceiling of chip enterprises rises sharply. The first generation of relatively large chip companies, such asSpreadtrum andZhaoyi innovationAfter listing, the market value remained at 30 billion yuan for a long time. The market value of chip companies in Jinke Chuang board is much higher. Even if 50% off, most of them are more than 30 billion yuan.

Zheng Weihe, chairman of Tongchuang Weiye of RMB fund, also quoted the word "dream" to describe the scientific innovation board. For example, the price of SMIC's shares in Hong Kong is less than HK $20 for most of this year, while the highest price of a shares is more than 95 yuan.

"How much responsibility, how high the market value," said a former semiconductor investor. According to incomplete statistics, by the end of the third quarter of this year, among the 28 semiconductor enterprises listed on the science and innovation board, excluding two companies with losses (no P / E ratio), the average p / E ratio was 145 times. Cheng miaoqi, partner of Qingsong fund, believes that the normal should be about 40 times, and the high P / E ratio overdraw the growth space of the enterprise too early.

A former Huaxia Fund Manager also said that "absolute valuation is no longer applicable in the secondary market". They compare the relative valuation method with the relative position in the industrial chain, such as chip manufacturing leader SMIC international and sealing and testing leader Changdian technologycontrast, estimated value.

Investors and entrepreneurs also smell the opportunity of China core. Once chip enterprises enter the supply chain of Chinese consumer electronics companies, especially Huawei, they are not far from listing on the science and innovation board.

A typical representative of domestic substitution is sirip, an analog chip supplier invested by Walden International in 2014.

Established in 2008, sirip's annual revenue from its main business was only RMB 113 million by 2018, and the valuation after fund-raising the next year was only RMB 900 million.

However, in 2019, an undisclosed major customer brought a revenue of 170 million yuan to sirip, raising the revenue of the whole company to 300 million yuan. This soon met the listing standards of the science and innovation board. Analysts believe that the big customer is Huawei: sirip was certified as a qualified supplier by Huawei at the end of 2017 and won the investment of Huawei Hubble in 2019.

In September this year, sirip landed on the science and innovation board, and its share price rose 77% on the first day. At present, it has a market value of 27.7 billion yuan.

From artificial intelligence to automatic driving and 5g, there is no lack of new concepts in the chip

Even if there is no domestic alternative, the chip began to rekindle the interest of investors five years ago.

On a global scale, chips are paid attention to with the popularity of artificial intelligence. Zhang Fei, a partner of Wuyuan capital who invested in horizon robot in 2016, told latepost that he expected artificial intelligence to be a huge paradigm change, which could create opportunities of more than US $trillion, which may be 3-5 times the market value of the IT industry.

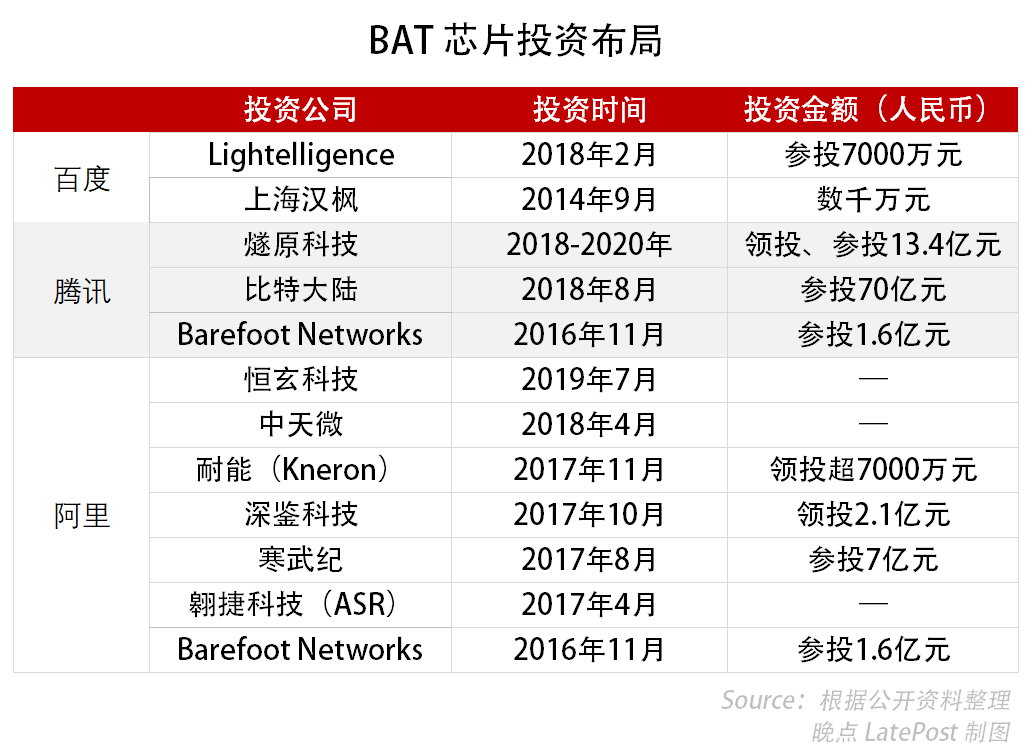

2015 is the first year of AI investment. Google, Amazon, Facebook and other companies have also entered the field of artificial intelligence chips. Ali, Tencent and Baidu also paid attention to this field.

During the same period, a number of chip companies such as horizon robot, pony Zhixing, Cambrian, bitland, Shenjian technology and so on also emerged. Since 2017, artificial intelligence algorithm companies such as yunzhisheng and Yitu technology have also begun to design chips to build a moat.

At that time, great changes also took place in the chip industry. According to IC insight data, global semiconductor M & A amounted to US $103.3 billion in 2015, and the total transaction volume in 2016 exceeded US $98.5 billion, almost the sum of 2010-2014. An investor said that this is a way to expand categories and scale. Chip companies have high technical barriers and extremely subdivided scenes. Even if they have technical strength, it is difficult to grow by themselves.

China's chip companies that landed on NASDAQ in the 3G era have also experienced a wave of privatization and M & A. In 2013, Ziguang Group acquired Spreadtrum communications with a total price of US $1.8 billion; In 2014, Ziguang completed the acquisition of radico microelectronics at a price of US $907 million.

This also drives a group of veterans to start a second business. In 2015, Dai Baojia, founder of radico, founded Aojie technology, and Zhang Liang, an old employee, founded hengxuan technology, both of which were invested by Ali and others.

In 2018, Zhao Lidong, who once worked in AMD for chip design and R & D and vice president of domestic Ziguang group, founded Suiyuan technology. Since May 2018, Tencent investment has been overweight for three consecutive times. This is also the one with the fastest valuation growth among the chip projects invested by Zhenge. "After seeing you that day, I signed it that day," said Yin le of Zhenge fund. The valuation of RMB 200-300 million has been included, and now the valuation has reached RMB 5 billion.

The artificial intelligence boom has passed, and the asset targets have undergone a reshuffle. Cheng miaoqi, partner of Qingsong fund, mentioned that the number of investments has decreased significantly since 2019.

But a new upsurge has come. In the view of investors, the future is an era of 5g, Internet of things, cloud computing, automatic driving, etc.

In 2017, Intel acquired moblieye, an Israeli autopilot chip company, for us $15.3 billion. In the same period, the market value of Tesla, Mobileye's largest customer, was only $40 billion. Two years later, Mobileye became the business line with the highest growth rate of Intel, with a year-on-year increase of 26% and a revenue of more than $1 billion.

In China, auto chip companies such as Xinchi technology are invested by Sequoia, Jingwei and other institutions.

Each segment has benchmarking. Bi Ren technology, founded by Zhang Wen, former president of Shangtang technology in 2019, has become the "next NVIDIA" in the eyes of investors. Within two months, Bi Ren technology announced that round a financing had exceeded 1 billion, and round B financing had been completed on August 18.

Bi Ren technology "didn't have ppt at first", an investor familiar with the situation recalled to latepost later. However, this does not prevent it from being concerned by hundreds of investment institutions. Not long ago, NVIDIA's market value surpassed Intel for the first time.

Time is not necessarily a friend

In Silicon Valley, which started from military orders in the 1950s, most of the old venture capital institutions have chip investment experience. But in China, after the lesson of wrong investment, only a few investors have reached the harvest period.

The first batch of players who invested in chips were represented by venture capital IDG, semiconductor investment institution Walden International and Lenovo Junlian capital. The second batch is mainly the old US dollar funds that Silicon Valley entered China in 2005, such as northern lights venture capital. After the opening of the gem in 2009, RMB funds have also been more actively deployed in the chip field. But overall, there are few investors.

Early winners basically have the accumulation of relevant industries. IDG partner Li Xiaojun, who is a semiconductor professional, once worked in chip design companies such as Meiman technology and grasped chip design projects such as radico and Xinyuan microelectronics. Dai Weili, founder of Meiman technology, and Dai Weimin, founder of Xinyuan microelectronics, are brothers and sisters. Chen Liwu, founder of Walden International, is still the Global CEO of cadence, an EDA company. In 1998, he invested in Xintao technology, a chip design company. Deng Feng, founder of Aurora Borealis venture capital, once served as a 1985 instructor of Tsinghua radio department. Zhao Weiguo, chairman of Ziguang group, and others are his students.

But accumulation does not guarantee success. After the ZTE incident in 2018, Zhu Xiaohu, a partner of Jinshajiang venture capital, once said at an investment forum, "in fact, we don't don't invest in chips. Before, we invested in several chip companies, which have lost their money and contributed to China's scientific and technological innovation." Wu Yanjun, a former partner of Jinshajiang venture capital and a former Bell laboratory worker, once led the investment in crystal energy optoelectronics, crystal poly and other projects, but failed to be successfully listed or merged.

Similarly, Zhou Zhixiong, a former partner of Softbank Saifu fund and founder of triumph venture capital, also mentioned that "my return in this industry is not the worst, but also the penultimate". He invested in chip design company worldchip electronics in two rounds from 2004 to 2006. There was no follow-up fund-raising and IPO after Shixin electronics.

Chip investment cycle is long and uncertainty is high. Sequoia once invested in Geke microelectronics in 2006. Geke microelectronics applied for the scientific innovation board this year, which has experienced a long 14 years. In 2004, Lightspeed capital invested in the chip equipment company Zhongwei, which was listed on the science and Innovation Board 15 years later. Dollar funds generally have an investment cycle of ten years.

In a speech reviewing the 20 years of China's venture capital industry, Zheng Weihe, chairman of Tongchuang Weiye, mentioned that the most profitable case in the investment industry is sig (Haina Asia) investment, which makes headlines today. The scale of no unexpected return should be 100 billion yuan. The number of RMB fund IPOs is large, and it is very difficult for a project to return 1 billion yuan.

However, a number of RMB funds have achieved a single return of more than 1 billion yuan in the chip field that was not optimistic in the past.

On April 28, 2018, shortly after the US Department of Commerce sanctioned ZTE, cornerstone capital, yuanhepuhua, Wu Yuefeng capital and others invested in Huawei camera supplier Howell technology. In 2019, Howell technology was successfully incorporated into the listed company Weill shares, and the share price of Weill shares rose sharply. On July 10, Weill shares exceeded 200 billion, compared with 20 billion in 2019.

The deal created high returns for two local renminbi funds. He invested in Weier semiconductor in 2011 and 2014, invested a total of 40 million in CO creation, and withdrew in 2019 with a return of 900 million yuan. It has invested more than 100 million in the cornerstone capital of howay technology. Over the past two years, the floating profit has reached 1.5 billion yuan.

An investor told latepost later that an institution invested in the chip equipment company Zhongwei in 2018 and now makes more than ten times. On July 22, 2019, on the day of the listing of the science and innovation board, the market value of medium and micro enterprises exceeded 60 billion yuan, and then once exceeded 100 billion yuan.

According to the latest market value, iFLYTEK's angel round investment in Cambrian in 2016 may make a profit of one year's net profit. In early November, the Cambrian market value once exceeded 75 billion yuan, and iFLYTEK held 1.19% with a value of nearly 900 million yuan. In 2019, iFLYTEK's annual net profit was only 788 million yuan.

Money alone is not enough

In a 2019 report, the U.S. Department of Defense said that the concentration of chip production in East Asia is a "single point of failure" for the U.S. science and technology industry. If there is a problem in the chip supply there, it will endanger the entire U.S. science and technology industry, including the military industry.

On the contrary, this single weak link is the same or even more urgent for China. After Huawei was sanctioned by the United States, the problem of insufficient coverage of Chinese companies in the chip industry chain was put on the table.

In the field of chip design, Huawei Hisilicon has squeezed into the top ten in the world. However, as the United States stopped authorizing EDA chip design software and asked TSMC to cut off supply, Huawei mobile phones could not get chips with 7 nm and 5 nm processes, and it was difficult to achieve the same performance as apple and Samsung.

At present, various fields such as materials in the upstream of the chip industry chain, equipment from design to midstream, manufacturing and downstream packaging and testing are very popular. However, most capital is still invested in asset light chip design companies like Hisilicon.

According to the statistics of Yunxiu capital, as of August 12, 2020, nearly 71% of chip related investment went to chip design companies, and only 15.3% were companies in the field of chip materials and equipment - 1.3 percentage points higher than that in 2019.

At the same time, the investment targets selected by investment institutions are becoming safer and safer. In the first half of this year, the proportion of investment after round C increased significantly, from 8% in 2017 to 21.9%.

Another change is that it is increasingly difficult for financial investors and industrial capital to seize the investment target. Industrial capital has great advantages, which can not only bring funds to the invested enterprises, but also orders.

In 2011, with the support of the national high tech investment and Shanghai Science and innovation investment group under the national development and Reform Commission, Walden International established the China semiconductor industry fund Shanghai Huaxin, with a scale of 500 million. Its LP also includes semiconductor companies such as TSMC, arm and Fujitsu.

Industrial funds dominated by consumer electronics companies also have more advantages than pure financial investment.

Lingming photon originally tried lidar chip, which was not favored by most investors at the beginning. This year, Lingming photonics launched the 3D sensing ranging sensor on the mobile phone, which attracted the attention of more institutions, but at this time, the founder was not so easy to make an appointment, said a PE investor involved. In October, Lingming photonics accepted the shares of Xiaomi industry fund.

The bigger one is Huawei. In April 2019, Huawei established Hubble investment, with a registered capital of 700 million yuan. In January 2020, its registered capital has reached 1.7 billion yuan.

"In the real world, our evaluation of things will swing between two extremes, 'very good' and 'not so good'. But in the investment world, the two extremes of the emotional pendulum are 'good to perfection' and 'bad to hopeless'." Howard & middot, founder of oak capital; Marx concluded in the cycle.

In just a few years, the sentiment of Chinese investment institutions towards chips has experienced a transition between two extremes.

This article is reproduced from“Late team”, support the protection of intellectual property rights. Please indicate the original source and author for reprint. If there is infringement, please contact us to delete.

Copyright © Shenzhen Kinghelm Electronics Co., Ltd. all rights reservedYue ICP Bei No. 17113853